SUSTAINABILITY

REPORT

2021

Alternatively, use the arrow keys

to navigate the report

Alternatively, use the arrow keys

to navigate the report

Message

From The Board

Of Directors

Fernando Lage de Melo

President

Welerson Cavalieri

Vice-President

Cláudio de Oliveira Torres

Councilor

Emílio H. Carazzai Sobrinho

Councilor

Henrique Augusto Mourão

Councilor

Márcio Rezende Magalhães

Councilor

Otávio Romagnolli Mendes

Councilor

- Message from the board of directors de Administração

- |

- Sustainability Report 2021

In line with the new dynamics of the world's development banks, which requires greater focus on sustainable investments with positive impacts and good financial results, the Development Bank of Minas Gerais (BDMG) remains at the service of the people of Minas Gerais, as a solid and innovative institution on the eve of its 60th anniversary.

This report consolidates the advances made by BDMG in 2021 towards the sustainable development of the State of Minas Gerais. We sealed our commitment to contribute to the climate agenda

by joining the Race to Zero campaign sponsored by the United Nations, together with the Government of Minas Gerais, as the largest coalition of leaders committed to one goal: achieving zero net greenhouse gas emissions by 2050.

BDMG's contribution to the sustainability agenda is evident in the investments in renewable energy projects that, last year alone, amounted to around BRL 207 million, with impacts estimated at 7,665 tCO2e/year of greenhouse gas (GHG) emissions avoided and generating 102 GWh/year of clean energy.

If, on the one hand, BDMG has worked on expanding its portfolio of sustainable projects, on the other hand, it has sought to maintain its financial sustainability. Despite the adversities and still under the uncertainty caused by the pandemic, we ended 2021 with a historic net income of BRL 220.9 million, compared to BRL 25.6 million recorded in 2020, which is the result of great commitment and dedication to our mandate to promote the sustainable socioeconomic development of Minas Gerais, generating employment and income.

The crisis once again showed BDMG's ability to act in an anti-cyclical manner, responding to the urgent needs of the Minas Gerais productive sector. The importance of BDMG in expanding credit, especially for micro and small companies, and in maintaining jobs and income was highlighted, showing that the institution makes a difference in the lives of the Minas Gerais population. The Bank's capillarity via a digital platform, together with its network of accredited banking correspondents, meant that loans disbursed in 2021 reached 526 of the 853 municipalities in Minas Gerais, 82% of them with a Human Development Index (HDI) below the Brazilian average.

With regard to the public sector, throughout 2021 BDMG carried out activities for structuring concession projects, structuring privatization processes and demobilizing assets of state-owned companies in Minas Gerais, providing specialized advisory and technical assistance services. Among these services are scenario assessments, economic-financial assessments, legal analysis, modeling, technical assistance in the preparation and execution of asset demobilization.

- Message from the board of directors de Administração

- |

- Sustainability Report 2021

In this way, BDMG works as a partner of the State in the structuring of strategic projects, in alignment with the Public Policies defined by its shareholders and expands its services as a provider of specialized services, which brings positive results for its cash generation, revenue diversification and financial sustainability.

The Board of Directors has supported initiatives to further strengthen governance standards, with a risk approach in line with the current credit scenario, the new strategic planning guidelines, the interests of the State and the Institution's economic and financial strength. The revision of the Risk Appetite Statement and the Liquidity Risk Management Policy are good examples of this.

Although the 2022 scenario remains challenging, since the beginning of the crisis brought about by the pandemic, BDMG has been improving its internal controls and compliance policies, and also expanding and deepening national and international partnerships, showing Minas Gerais society what it really is - a development bank that makes a difference in people's lives.

We will continue our strategy of aligning our portfolio as a development bank committed to the future of future generations, increasingly in tune with the actions of the State Government, supporting both the productive sector and the municipalities of Minas Gerais in order to promote socioeconomic development for Minas Gerais and reducing regional inequalities.

The Board of Directors renews its sense of accomplishment, in the certainty that in 2022 we will be in tune with government public policies, showing a strong sense of management to enhance our results.

Fernando Lage de Melo

Chairman of the Board of Directors of BDMG

Message From The

Chief Executive Officer

Marcelo Bomfim

Chief Executive Officer of BDMG

- Chief Executive Officer

- |

- Sustainability Report 2021

It is my great satisfaction to present to the people of Minas Gerais the results obtained by BDMG's technical and management teams throughout 2021. The indicators presented here materialize the role of this honorable institution’s role as a vector supporting the sustainable social and economic development of Minas Gerais. At the same time, they reinforce the commitment to maintain a level of governance and transparency in keeping with the aspirations of society and our shareholder, the Government of Minas Gerais.

During the year, despite the challenging scenario triggered by the health crisis, BDMG remained active as a financial agent in the productive sector, as well as in the public sector of Minas Gerais, without neglecting the continuous monitoring of risks associated with the preservation of the institution's financial strength.

BDMG is committed to continually improving its risk management instruments for the increasingly efficient exercise of its role as a provider of competitive credit solutions, project structuring and provider of specialized services. In 2021, the Bank's operations generated a positive impact of R$1.47 billion on Minas Gerais’ production and stimulated around 22 thousand jobs, signaling the vocation of its technical staff to adapt to different scenarios and build effective opportunities.

In line with the Sustainable Development Goals (SDGs), which are part of the UN 2030 Agenda, BDMG has strengthened its commitment to contribute to a responsible climate transition.

- Chief Executive Officer

- |

- Sustainability Report 2021

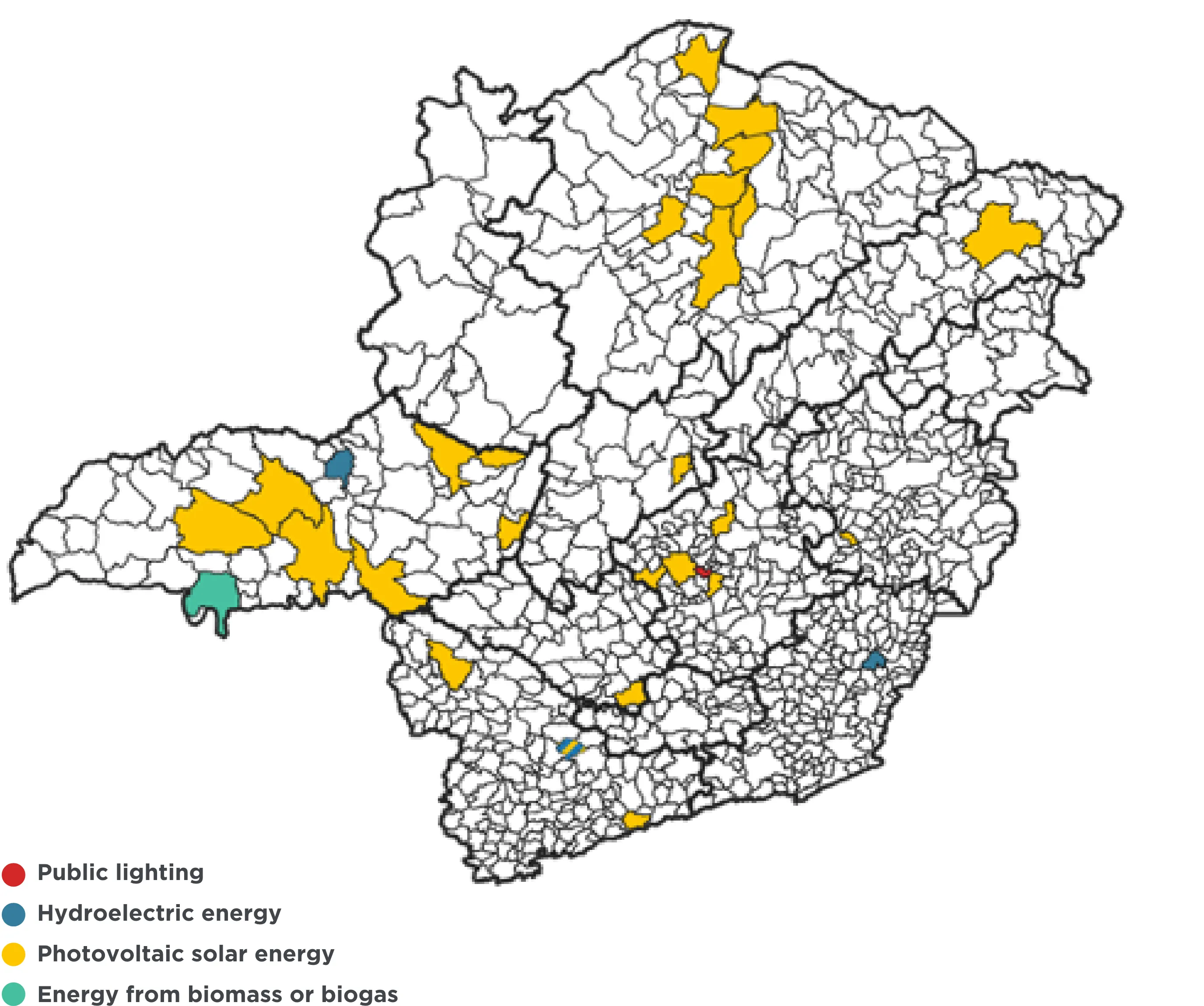

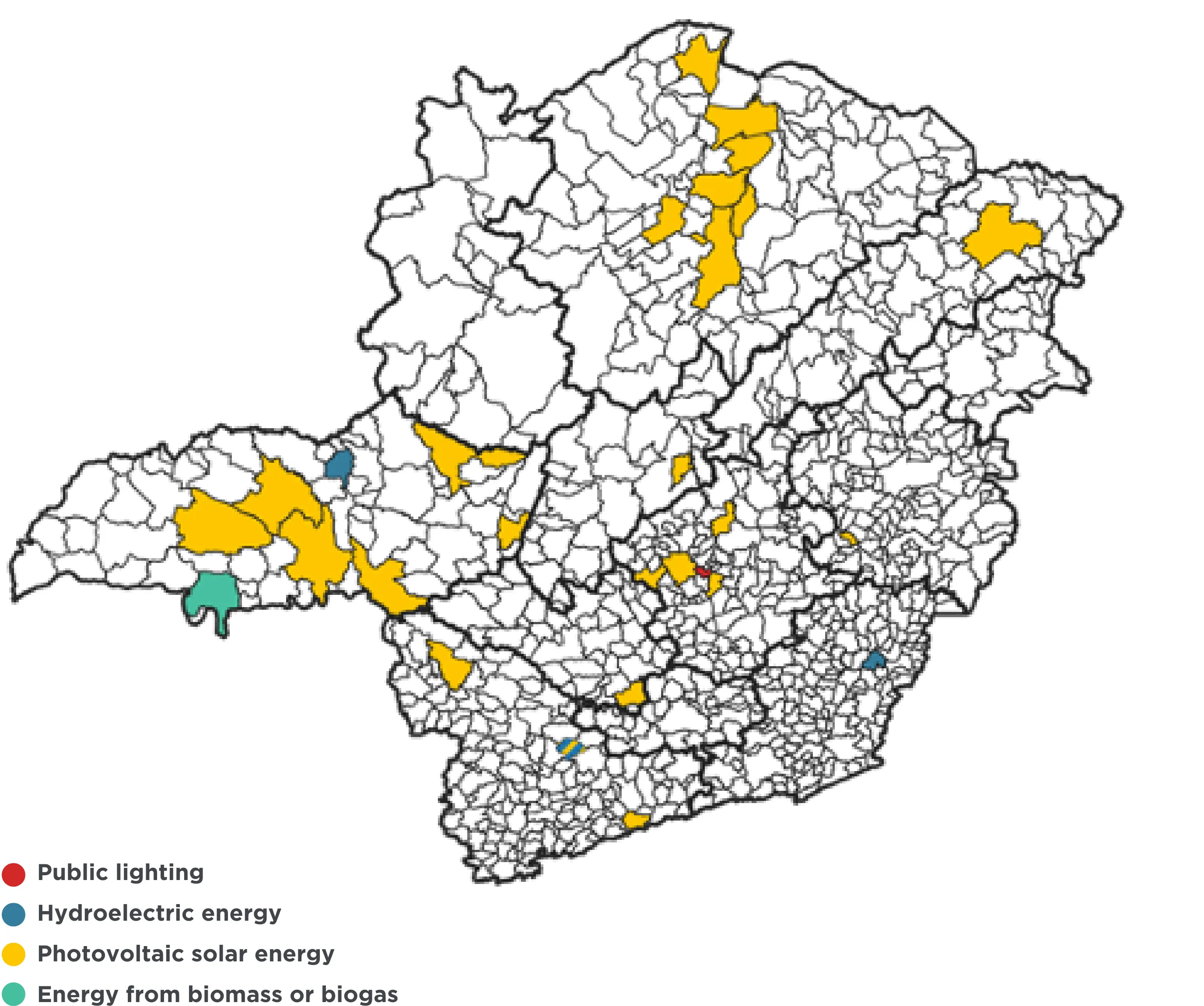

Environmental impact projects, notably in the area of renewable energy, energy efficiency and sanitation, received credits in the amount of R$ 187 million. The solar energy initiatives in 18 municipalities, mainly in the North of Minas, were a highlight, contributing to the conversion of the region's natural potential into effective regional development. At the same time, we registered the adhesion – together with the Government of Minas Gerais – to the Race to Zero program, a global campaign that aims to achieve net zero greenhouse gas emissions by 2050.

Another relevant action by BDMG in the field of sustainability was financing the healthcare sector. The supported projects directly benefited 455,000 people, including more than 52,000 patients and 9,900 workers, in addition to enabling the manufacture of 8,000 items including medicines and other hospital, pharmaceuticals and clinical products and equipment. Throughout the COVID-19 pandemic, these results become even more in keeping with the role one expects from a development bank in complex moments such as the ones we are experiencing.

On another front, we allocated R$91.8 million to urbanization, sanitation and public service improvement projects, with 93% of the disbursement associated with SDGs. BDMG is committed to increasingly strengthening its integration with the municipalities of Minas Gerais, especially those whose access to credit in the traditional market is limited. To this end, the offering of lines with accessible conditions and that meet the real demands of city governments, in addition to greater institutional dialogue, are inflections that we want to make increasingly stronger.

It should be noted that all this performance in granting greater liquidity opportunities to entrepreneurs and cities went hand in hand with an attentive management of the institution's financial strength indicators. A reflection of this was the bank's excellent result for the year.

As it enters its 60th year, BDMG will actively work to fulfill its purpose in an innovative way, with constant improvement in transparency, financial management and governance. In dialogue with the Government of Minas, we will increasingly strengthen the Bank's knowledge of local realities and build timely, effective responses for regional development, with an emphasis on overcoming the economic challenges of the most vulnerable social strata.

After all, BDMG is a heritage of “Mineiros”! We will maintain this focus, connected to governmental public policies and global and local development agendas. With a strong sense of management, our teams are engaged in enhancing results for the people of Minas Gerais, unveiling a more sustainable future, sensitive to social demands.

Marcelo Bomfim

Chief Executive Officer of BDMG

- Chief Executive Officer

- |

- Sustainability Report 2021

Economic

Scenario

- Economic Scenario

- |

- Sustainability Report 2021

After a promising first semester, the 2021 fiscal year ended with a slowing pace of economic recovery for the Brazilian and Minas Gerais economies. The unfolding of the pandemic, with the emergence of new variants of the coronavirus and the response policies of zero-tolerance Asian countries, led to interruptions in industrial production and a reduction in the pace of service providers, which impacted production chains on the global level.

In 2021, despite the forecasts having also been revised downwards, the published economic activity indicators for the 3rd quarter indicate that the Brazilian economy has recovered compared to that at the onset of the pandemic period. The growth of industry and commerce and the recovery of services tend to determine a growth of the Brazilian economy between 4.5% and 5%. In the latest analyses of the PNAD-C (Brazilian Census survey), some signs of recovery of the labor market occurred, with the employment rate growing more than the market share, which may be a sign of relief for sustained consumption.

The factors determining a performance below previous expectations for 2021 are related to an increase in oil costs, problems with the industrial components supply of industrial components, the impacts of the water crisis, high unemployment, impacts of inflation on the mass of income and the interruption of production in industrial segments that import components, in addition to the impact of these elements on investor expectations.

Although the governments of the developed nations have been sustaining the economic recovery with expansionary monetary and fiscal policies, the instability in the supply of industrial inputs has imposed a slower pace than expected, combined with a rise in the general price level. The same process affects emerging economies more intensely, in which inflation and the interruption of the supply of components are added to less fiscal elbow room and an unequal rhythm of vaccination coverage among the populations, with negative effects on society and the economy. For this reason, central banks around the world, including Brazil, have been reviewing their positions, planning the progressive withdrawal of monetary stimuli and an increase in domestic interest rates.

The international situation has become even more challenging since the end of February this year, with the start of the Russo-Ukrainian war.

- Economic Scenario

- |

- Sustainability Report 2021

The sanctions on Russia have led to a restriction in supply, caused price increases, especially in commodities — highlighting the increase in the prices of oil, natural gas, metals and wheat, products of which Russia and Ukraine have a high share in the global supply — and intensified the inflationary processes in the world. In response to the rise in the general price levels, most Central Banks have raised basic interest rates, with effects on liquidity and global economic growth.

OECD estimates indicate that the conflict in Eastern Europe is expected to subtract at least one percentage point (pp) from world growth and add more than 2.5 pp to previously forecasted global inflation. In Brazil, the acceleration of the inflationary process has materialized in fuel prices and higher inflation expectations, demanding a reaction from the monetary authority at the last meeting of the Monetary Policy Committee (Copom).

This adverse international scenario has a negative impact on the expectations of economic agents in Brazil, with the postponement of investment decisions in production and bond issues. As a consequence, macroeconomic consultants have revised their growth forecasts for 2022 downward — to variations of less than 1% (+0.3% pa in the Focus survey at the end of January 2022).

In 2022, the Central Bank should place more emphasis on controlling the inflationary process and, consequently, will maintain higher interest rates, discouraging investment decisions. Counterbalancing this scenario, there is an impulse to consumption arising from government income transfer programs associated with a slightly higher employment level, in addition to maintaining a good export performance for Brazilian and Minas Gerais commodities.

- Economic Scenario

- |

- Sustainability Report 2021

In Minas Gerais

In the case of the regional economy, the same positive factors that acted in 2021, with emphasis on the good performance of the export segment, more specifically, appreciation in coffee prices in the international market and some recovery in the price of ore in recent months, the Minas Gerais manufacturing industry, especially the automotive industry, also achieved outstanding performance in the period.

In the first half of the year, the Minas Gerais economy showed a more robust recovery than in Brazil on the whole, and, in April 2021, it was already at a higher level than in February 2020. Above all, both the Transformation and Extractive sectors were responsible for a more intense recovery, in relation to the pre-pandemic level. In this context, the Gross Domestic Product of Minas Gerais increased 5.1% in 2021 – a result higher than the Brazil’s (4.6%). The advances in industry (9.2%) and services (4.1%) contributed to the result. On the other hand, agriculture fell by 8.4% – driven by a biennial decline of coffee production.

The better performance of the state's GDP in relation to the country's GDP was mainly due to the international economic situation. The heated demand for commodities and the recomposition of global supply chains favored important sectors in the state’s production structure, such as the mining and metallurgical segments.

- Economic Scenario

- |

- Sustainability Report 2021

Services, especially those provided to families, were, on the one hand, benefited by better epidemiological conditions, resulting from the advances in vaccination, and, on the other, had limited performance by the fall in general income.

For 2022, the expectation is that economic activity will lose momentum. The slowdown of the global economy, influenced by the conflict in Eastern Europe, the lack of essential inputs for production and the global rise in prices, and the increases in interest rates and household indebtedness are expected to negatively impact economic growth. In contrast, the appreciation of commodities prices and the exchange rate at a historically depreciated level should positively influence the state's exports.

The performance of the Minas Gerais economy in 2022 will depend on the same factors that will impact the Brazilian economy, with a growth perspective of less than 1% pa.

As long as the negative effects of supply interruptions and rising energy costs continue to negatively impact the recovery of industrial activity and associated services, positive biennial growth in coffee, among other factors, signal positive counterpoints in the economic outlook. In both spheres, the possibility that the advancement of vaccination coverage will minimize the social and economic effects of new coronavirus variants will be decisive for the performance of economic activity.

Whatever scenario materializes, the current trend of directing part of the liquidity available in the global financial markets to the sustainable development agenda should prevail.

Trajectory

- Trajectory

- |

- Sustainability Report 2021

BDMG’s trajectory began in 1962, when the Bank took on the role of active promoter of the development of the State of Minas Gerais, through the investment of funds in financing. Its mission was to establish conditions for development with a focus on growth of industrial activity, especially for micro and small companies. It would operate as a provider of technical and financial conditions for projects of state interest;, effectively allocating capital, nationally and internationally, in order to provide for equitable development.

In addition to participating in the creation of highly relevant entities1, BDMG prepared important economic studies, sharing differentiated knowledge, which served as a basis for the planning and design of economic and social strategies for several governments.

Today, BDMG supports companies of all sizes and sectors, municipalities and municipal public utilities. It is also the official organizer of the State in regular concession operations and in Public-Private Partnership (PPPs) models.

In line with Environmental, Social and Governance (ESG) principles, its strategy focuses on contributing to the 2030 Agenda and the Sustainable Development Goals (SDGs) adopted by Brazil and other UN member countries.

Notwithstanding the national and international economic fluctuations over the institution's 60 years, BDMG's support for strengthening the productive sector has been essential for the evolution of the State of Minas Gerais.

1 Minas Gerais Industrial Development Institute (INDI), the João Pinheiro Foundation (FJP), the Minas Gerais Industrial District Company (CDI/MG) and the Management Assistance Center (CEAG), which gave rise to the Brazilian Support Service to Micro and Small Enterprises (Sebrae).

Starting point

- Creation of the Department

of Socioeconomic Studies -

1st Agreement

with BNDE -

Support program for

agribusiness and mining

- Trajectory

- |

- Sustainability Report 2021

Support to sectors of the economy

- Recovery of the Sugar Agroindustry Program

- Support to the mining-metallurgical sector (Açominas, Usiminas, Acesita, etc.)

- Opening of the Fiat factory in Betim with the decisive support of BDMG

- Development Program for the Coffee Industry

- Continued support for state industrialization

State Funds

- Experience in the capitals market (IPO for Cedro Cachoeira Itaunense)

- Consolidation of support role for State planning through economic studies

- Creation of state funds managed by BDMG, one of the main sources of funds until the 2000s

Strategic Projects

- Experience in the capitals market (IPO for Cedro Cachoeira Itaunense)

- Consolidation of support role for State planning through economic studies.

- Creation of state funds managed by BDMG, one of the main sources of funds until the 2000s

- Trajectory

- |

- Sustainability Report 2021

Diversification of funding and Digital BDMG

- Decrease in State Funds

- Funding diversification

- Launch of BDMG Digital and strengthening of operations through banking correspondents

- Strengthening of customer acquisition strategies and new business model

- Strengthening of risk management, credit management and collateral management

- Direct and indirect participation in strategic companies in the State

- Organizing measures in strategic segments in the state: innovation, sustainability, agribusiness and regional development

Global development agendas and anticyclical measures

- Alignment with global development agendas and ESG principles

- Reinforcement of countercyclical measures in response to COVID-19

- Reinforcement of BRL100 MM in the capital structure

- Record funding (BRL 2.3 billion)

- Leader of Funcafé transfer leader

- Publication of the SDGs Framework and issuance of Sustainable Bonds

- Engagement in privatization and state infrastructure projects

- Signatory of the UM Global Compact MG State Government joined Race to Zero Campaign (zero liquid emissions of GHG by 2050)

- Prêmio CFI Brazil 2020 Best Socio-Economic Impact Bank.

Strategy

- Strategy

- |

- Sustainability Report 2021

In 2022, BDMG completes its 60 years of existence, guided by the 2022-2026 Strategic Plan with medium and long-term objectives to ensure the attainment of its vision of the future: to be a reference as a local development bank focused on impact.

In line with the Minas Gerais Integrated Development Plan – (PMDI), BDMG operates as a state agent for the development of sectors and regions in Minas Gerais, mobilizing international and private funds, implementing impact projects and technical cooperation. It also contributes to increasing the efficiency of the state with privatization projects and public-private partnerships.

The objective of these actions is to turn initiatives into reality, making a difference in the lives of the state’s population.

To this end, BDMG seeks to balance its operations between B (bank) by ensuring financial sustainability; D (development) by maximizing impact and development; and MG (Minas Gerais) specializing in its territory. Thus, it aims to simultaneously operate profitably, with operational and funding management excellence, fulfilling its role in promoting development, mobilizing funds and partnerships to serve the state of Minas Gerais.

Purpose

Transform initiatives into

reality, making a difference

in the lives of Minas Gerais' population

Vision

Be a world reference as

a local development

bank focused on impact

Pillars

B

Ensure financial sustainability

D

Maximize impact and development

MG

Be a specialist in Minas Gerais

to generate value for society

- Strategy

- |

- Sustainability Report 2021

This is carried out through services to micro, small, medium and large companies, rural producers and the public sector of Minas Gerais and neighboring states, in the financing of projects that generate impact.

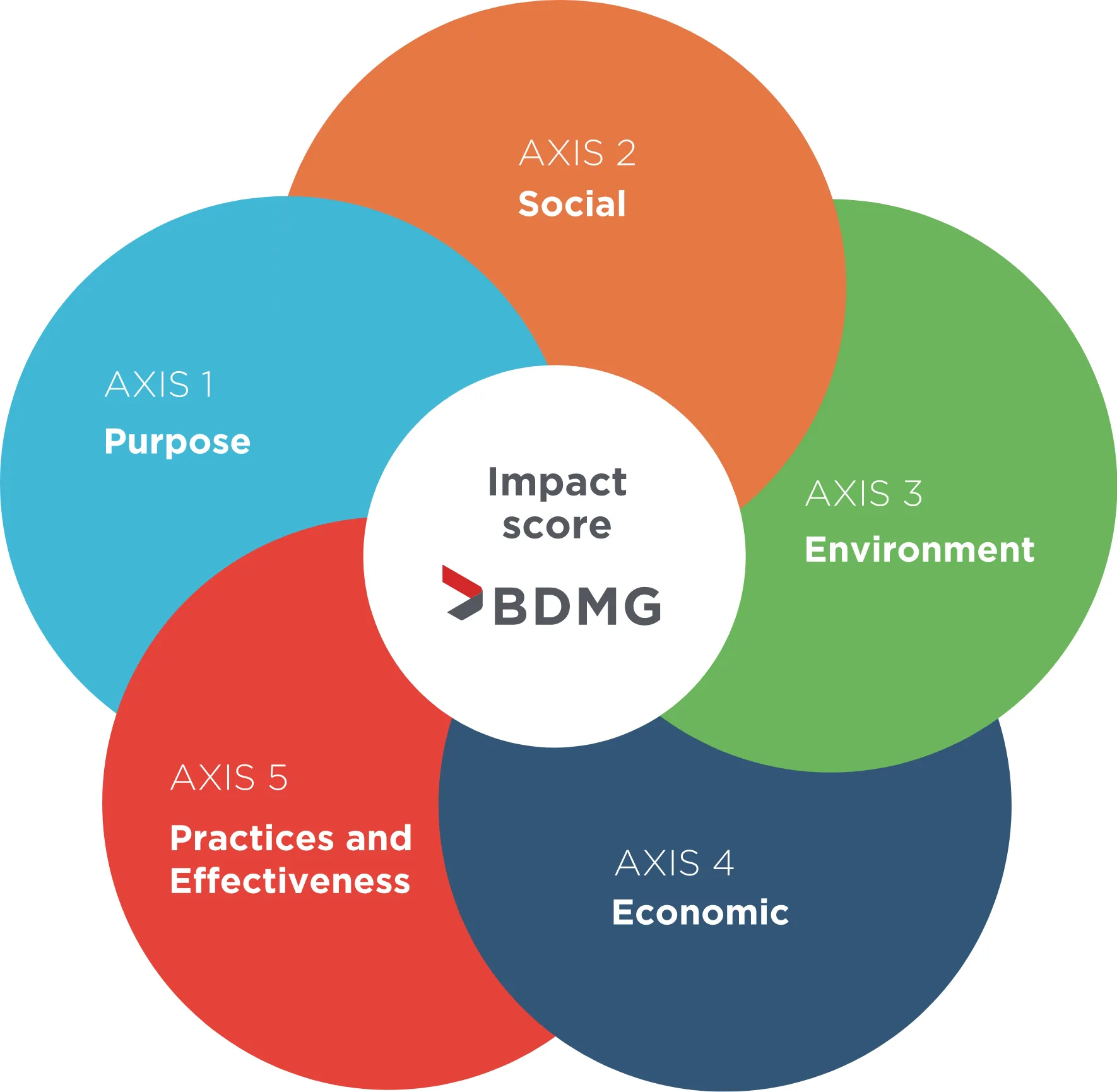

This impact is measured by aligning the environmental, social and economic effects of disbursements with the Sustainable Development Goals – SDGs, anchored in the 2030 Agenda, focusing on 5 impact commitments for BDMG operations in the coming years:

Financial inclusion:

guarantee access to financial services on favorable conditions for micro and small enterprises, supporting the maintenance of jobs.

Clean energy:

expand the renewable energy matrix, enabling investments in clean energy sources and energy efficiency.

Competitive, responsible companies:

having more inclusive cities and enabling infrastructure projects (sanitation, health, education, urbanization and inclusive spaces).

Inclusive, sustainable cities:

have more inclusive, sustainable cities, enabling infrastructure projects (sanitation, health, education, urbanization and inclusive spaces).

Low carbon agriculture:

enable investments in agro-innovation that ensure high levels of productivity and contribute to soil rehabilitation, biodiversity and reduction of GHG emissions.

- Strategy

- |

- Sustainability Report 2021

The 2030 Agenda and action

BDMG impact

BDMG contributes to 13 of the 17 SDOs and

28 of the 169 goals of the Agenda

- Strategy

- |

- Sustainability Report 2021

In addition to the impact commitments, BDMG's operations over the next five years will be based on the 6 strategic drivers that significantly interact with the institution's future:

Impact:

measuring the effects of the financing on society, strengthening its strategy by positioning itself as a regional specialist in facilitating development projects aligned with the Sustainable Development Goals – SDGs; also improving the monitoring and evaluation of the impacts of its operations in the development of the State.

Commitments to the 2030 Agenda and the Sustainable Development Goals (SDGs);

Positioning BDMG as a regional specialist in facilitating development projects;

Monitoring and Evaluation of the impacts of BDMG operations on the development of the state.

- Strategy

- |

- Sustainability Report 2021

Competitiveness:

BDMG is organized to grow in line with its capital structure. Its competitiveness lies in its excellence in financial solutions for development, which include services and consultancy, in addition to the constant improvement in customer experience, market adherence in terms of positioning and offer with profitability.

Excellence in financial solutions for development, including services and consultancy;

Constant improvement in the customer experience;

Adherence to the market in terms of positioning and supply, with profitability.

- Strategy

- |

- Sustainability Report 2021

Partnership:

for BDMG, development and impact can be enhanced by partnerships, which are a means of enabling the implementation of the strategy and the effectiveness of its operations. For this, BDMG is constantly exploring new business opportunities, including institutions with the same “DNA”, for the transfer and dissemination of knowledge, as well as the mobilization of resources for relevant projects in Minas Gerais and neighboring states.

Exploring new business partnerships, including institutions with the same DNA;

Operate as a platform for the production and dissemination of knowledge;

Mobilize funds for Minas Gerais and neighboring states

Strengthen customer service partnerships.

- Strategy

- |

- Sustainability Report 2021

Organizational Culture:

for BDMG, the attainment of its objectives demands the alignment of leaders and teams with the organization's objectives; leaders capable of inspiring, engaging and developing other leaders; ability to continually learn, unlearn and relearn; ability to work with simplicity, agility and adaptability, as well as protagonism, proposing and taking on challenges.

Align leaders and teams with the organizational objectives;

Prioritize continuous and incremental deliveries whenever possible;

Simplicity, agility and adaptability;

Operate with protagonists, proposing and taking on challenges;

Strengthen governance, compliance and risk management practices.

- Strategy

- |

- Sustainability Report 2021

Digital Transformation:

Digital transformation is rapidly changing the business model in the development sector on a global scale, enabling funds from development programs to more efficiently reach the hands of those who need them. This involves being prepared to explore opportunities arising from digital transformation in the financial market.

Be prepared to explore opportunities resulting from changes in the financial Market;

Migration to the cloud - infrastructure as a service;

Data intelligence and artificial intelligence, as a way to support the decision-making process;

Automation, aiming at productivity gains.

- Strategy

- |

- Sustainability Report 2021

Financial Sustainability:

balancing the level of profitability and risk in order to attain a level of growth compatible with BDMG's capital structure. To this end, BDMG carries out periodic risk appetite and credit policy reviews, using tools for mitigating credit risk and monitoring scenarios, in addition to the continuous improvement of financial models and projections.

Periodic reviews of risk appetite and credit policy

Use of tools to mitigate credit risk and monitor scenarios

Growth compatible with BDMG's capital structure

Improvement of financial models and projections

Governance

- Governance

- |

- Sustainability Report 2021

Identity

Identity

Founded by State Law nº 2.607, of 01/05/1962, the Development Bank of Minas Gerais S.A. (BDMG) is a financial institution that promotes the development of the State of Minas Gerais and is part of the state's economic development system, linked to the Economic Development Office of the State of Minas Gerais (SEDE).

It is a public company controlled by the State of Minas Gerais, a legal entity governed by private law, part of the indirect administration,

operating in Minas Gerais or in neighboring states. Its headquarters are in Belo Horizonte, Minas Gerais.

As a development bank, it is part of the National Financial System, and its function is promoting social well-being by providing financial services that encourage investments by economic agents.

In addition to Minas Gerais, BDMG operates in four other Brazilian states: São Paulo, Rio de Janeiro, Espírito Santo and Mato Grosso do Sul.

Governance

Structure

The governance structure of BDMG comprises six statutory bodies: Board of Directors, Fiscal Council, Audit Committee, Risk and Capital Committee, Executive Board, Credit and Renegotiation Committee and Ombudsman, in addition to five other non-statutory committees: Management, People Management Committee, Information Technology Committee, Finance Committee and Product Committee. All of them are directly or indirectly subordinated to the General Shareholders’ Meeting, the highest decision-making body, as determined by law. The BDMG governance model is illustrated by the following organizational chart:

- Governance

- |

- Sustainability Report 2021

BDMG Governance Organization Chart

- Governance

- |

- Sustainability Report 2021

BDMG's Governance Structure is periodically reviewed to ensure the safety, efficiency and transparency of the institution. The statutory bodies have the following attributions:

Fiscal Council

The Fiscal Council is directly linked to the General Shareholders’ Meeting and has decision-making and supervisory attributions. It is made up of four effective members and three alternates and its role is assisting the General Shareholders' Meeting, providing technical opinions on the adequacy of the financial statements and on the fulfillment of the legal and statutory duties of the Institution's Managers. In addition, it has the attribution of communicating possible irregularities to the General Meeting, among others, and also preventing and correcting, administrative errors that may cause relevant impacts on BDMG in a timely manner.

Board of

Directors

The Board of Directors is currently made up of eight members, as provided for in the Bylaws, and is the main management body of BDMG, responsible for establishing the guidelines

for the Institution's activities in promoting the State's economic and social development. The Board has the following attributions, among many others:

• Approve and monitor the business plan and the long-term strategy for the Bank's activities in fostering the State's economic and social development activities, providing an annual analysis of compliance to the goals and the results of their attainment;

• Disclose the conclusions of the analysis referred to in the previous item on the BDMG website and communicate them to the Legislative Assembly and the State Court of Auditors; to the State Legislative and the State Audit Court;

• Approve external reports, internal policies and programs compatible with the State's plan and its relevant regional and sectoral development programs;

• Establish criteria for carrying out judicial and extrajudicial agreements and transactions.

- Governance

- |

- Sustainability Report 2021

Executive Board

The Executive Board is responsible for the general management of the Institution, seeking to ensure compliance with its institutional objectives and the effectiveness of the Board of Directors' deliberations to ensure its regular functioning. The Executive Board also submits to the Board of Directors the proposals on relevant matters of the Institution, as defined in the Bylaws.

The Executive Board is made up of five members, including the Chief Executive Officer, the Vice President and three Executive Officers, who meet weekly under the coordination of the Chief Executive Officer and, in addition to the general management of the Bank, they have the following attributions:

• Establish BDMG's general policies and guidelines, submitting them to the deliberation of the Board of Directors;

• Implement the strategy defined by the Board of Directors;

• Conduct the Institution's asset and liability operations not included in the decision-making powers of the Board of Directors or the Credit and Renegotiation Committees.

Audit Committee

The Audit Committee provides permanent support to the Board of Directors, in compliance with legal requirements. Currently, the Committee is made up of three members. The duties of the BDMG Audit Committee are, among others, to give an opinion, in order to assist the Shareholders in appointing Managers and Fiscal Council members, on the fulfillment of the requirements and the absence of possible impediments regarding elections; reviewing, prior to publication, the semi-annual financial statements, explanatory notes, management reports and the independent auditor's opinion; supervising and evaluating the effectiveness of the area of internal controls, controllership, independent and internal audits, as well as compliance with legal and regulatory provisions applicable to BDMG, in addition to internal regulations and codes.

- Governance

- |

- Sustainability Report 2021

Risk and Capital

Risk and Capital

Committee

The Risk and Capital Committee is a collegiate body made up of four members: the Chief Executive Officer (Committee Chairman), the Director Responsible for Risk Management, the Director Responsible for Capital Management and a member of the Board of Directors.

The Committee meets ordinarily at least once a month and quarterly with the Board of Directors to report on risk and capital management. Besides the attributions established by the Board of Directors and those in the applicable legislation, it is responsible for advising the Board of Directors on risk and capital management, providing a comprehensive and integrated view of the risks and their impacts and also assisting the Executive Board and the Board of Directors in establishing and reviewing the Institution's risk appetite levels.

Credit and

Renegotiation

Committee

The Credit and Renegotiation Committee is made up of representatives of the following areas: Credit Analysis, Operations, Credit Management, Products, Risks and Internal Controls, Planning and Legal Counsel.

It is the responsibility of the Credit and Renegotiation Committee to decide the limit and use of credit, renegotiation, changes in warranty and contracts, including credit cooperatives, up to the amount equivalent to 1% of the BDMG Shareholders' Equity, following the risk criteria defined by the Board of Directors, among other duties.

Ombudsman

The BDMG Ombudsman is structured as an administrative unit linked to

the Chief Executive Officer. The Ombudsman's term of office is two years, with only one reappointment permitted for an equal period. Its main attribution is to provide assistance, as a last resort, to customers and users of BDMG's products and services.

Complaints from customers and users of products and services are received through a 0800 hotline, recorded by the Customer Service Center (NAC) in a CRM system. The Ombudsman also deals with complaints sent by the Central Bank Ombudsman (BACEN), the Audit Committee and the State Ombudsman General (OGE/MG), ensuring compliance with deadlines and strict compliance with legal and regulatory rules on customer rights.

The number of complaints solved remained at the level of 2021, higher than in previous years, in line with the significant increase in the customer portfolio and renegotiations resulting from the pandemic.

- Governance

- |

- Sustainability Report 2021

Risk Management,

Internal Controls

and Integrity

BDMG has areas dedicated to risk management, internal controls, compliance and integrity, with independent actions linked directly to the Chief Executive Officer, which may be led by another Executive Director not responsible for the Bank's business activities.

The duties of the areas responsible for risk management, internal controls, compliance and integrity, in addition to others provided for in the specific legislation and BDMG's regulations, are:

• Advising the Board of Directors on the integrated management of risks, internal controls, compliance and integrity, proposing policies and strategies;

• Disseminate the culture of risk management, internal controls, compliance and integrity;

• Forward periodic reports to the Audit Committee on the activities.

The areas responsible for risk management, internal controls, compliance and integrity report directly to the Board of Directors in situations in which a member of the Executive Board is suspected of involvement in corruption or when a member fails to take the necessary measures in relation to a reported issue.

- Governance

- |

- Sustainability Report 2021

Exclusive issue of shares with voting rights (common), adopting the principle: one share – one vote;

Different people in the positions of Chairman of the Board of Directors and Chief Executive Officer;

Internal Regulations with clear definitions of the attributions and responsibilities of the Board of Directors;

Disclosure of summary minutes of the Board of Directors on the BDMG website;

Statutory committees;

Non-statutory committees to assist in governance, such as the information technology, people management, managerial, financial and product committees;

Formalization and public disclosure of the institution's corporate governance structure;

Implementation of the risk and capital committee, as an advisory body to the Board of Directors;

A tool to allow the monitoring of all steps in the process of granting credit;

- Governance

- |

- Sustainability Report 2021

Adoption of a strategy management model that allows the definition of objectives and the measurement of the final results of BDMG's operations;

Disclosure of the risk management model and strategic guidelines on the BDMG website;

Audit Committee, which reports to the Board of Directors, made up of at least three and at most five members, including up to three external independent members, according to BDMG's bylaws. At least two members must have proven knowledge of auditing and accounting that qualify them for the role;

Internal audit reporting directly to the Board of Directors and the Audit Committee, with periodic meetings;

Annual evaluation of the Internal Audit by the Audit Committee;

Systematic presentation of risk management practices to the Board of Directors;

Systematic presentation of internal control procedures to the Board of Directors;

No reservations in the opinions of the Independent Auditors in the last five years;

Direct and systematic relationship of the Independent Audit with the Audit Committee;

Annual evaluation of the Executive Board, collectively, and of each of its members, individually, by the Board of Directors;

Independent Auditors not allowed to provide other services to BDMG;

Update of the Code of Ethics, Conduct and Integrity published on the BDMG website;

There is a policy for operations with related parties;

Annual disclosure of relevant information on transactions carried out with related parties in the period.

- Governance

- |

- Sustainability Report 2021

In line with the best practices of Corporate Governance, in order to ensure the transparency of processes and alignment with the Institution's interests, transactions with Related Parties carried out by BDMG are governed by the provisions of BDMG Resolution No. 209.

This Resolution lists individuals and legal entities that can be considered as Related Parties of BDMG, which can control or have significant influence over the Institution's financial and operational decisions or enable the generation of benefits that are not consistent with standard market practices.

Some legal entities considered Related Parties as a result of transactions carried out with BDMG:

• The State of Minas Gerais (controller of the Bank) and companies whose capital, directly or indirectly, is held by the State, its autarchies, foundations, public companies and mixed capital companies;

• The legal entities of the Indirect Administration of the State of Minas Gerais.

- Governance

- |

- Sustainability Report 2021

According with CMN Resolution 4,693, of 10/2018, in its Governance Policy, BDMG considers management and fiscal councilors, officers, members of the Audit Committee and other advisory and governance bodies, and those holding positions of trust as Related Parties, and the contracting of credit operations to these or to companies in which they are shareholders is prohibited, if they have a share in the capital equal to or greater than 15%.

Integrity

and Compliance

Directly linked to the Chief Executive Officer, the Compliance Department's mission is to ensure that BDMG operates in a way that respects the rules of the organization, complying with laws and internal and external regulations, also encouraging ethical and responsible practices and promoting a culture of compliance that is essential for the safe and efficient attainment of its strategic objectives.

Management is responsible for encouraging integrity actions related to employees, customers, partners and other employees of BDMG; mitigating compliance risks and issue guidelines on queries regarding the practice of ethical conduct, together with the Ethics Committee.

In 2021, several internal rules were revised and updated, including those related to credit policy,

risks, people management, socio-environmental, prohibitions and impediments, protection of personal data and prevention of money laundering and financing of terrorists (PLD /FT).

In order to promote a culture of compliance, integrity and diversity, monthly reports were sent on the aforementioned topics to all BDMG employees.

Annual training sessions were held for members of the Executive Board and Board of Directors, Fiscal and Audit Committees on Governance, Risks and Compliance, including the main points of Law 13,303/2016, which provides for the legal status of state-owned companies; the Prevention of Money Laundering and the Financing of Terrorism, in compliance with Central Bank regulations, for members of the Executive Board, Audit Committee and employees, as well as training on Privacy and Protection of Personal Data, such as the enforcement of the General Law of Personal Data Protection (LGPD).

- Governance

- |

- Sustainability Report 2021

Ethics and

Integrity

The principles and values that guide the conduct of employees/staff are established in BDMG's Code of Ethics, Conduct and Integrity, applicable to all who have a mandate, position, function, job or provide services to the Institution, even if temporarily and/or non-remunerated. The Code was drawn up in accordance with Law 13,303, of June 30, 2016, which provides for the legal status of state-owned companies; its latest revision included specific provisions to address social media, conflicts of interest, side activities and receiving gifts.

The Ethics Committee, established by BDMG to ensure compliance, updating and dissemination of the Code of Ethics, operates in line with the institutional values of ethics, transparency and commitment to Minas Gerais society, and is available for internal consultation.

Some of the duties of the Ethics Committee, defined in its Internal Regulations and in State Decree No. 46,644, are to ensure compliance with BDMG's Code of Ethics, to follow the rules and guidelines of the Public Ethics Council of the State of Minas Gerais (CONSET) and guide and instruct people about professional ethics. It is the responsibility of the Committee, to investigate complaints of any conduct that may infringe ethical-professional principles or rules, among others.

The investigation of unethical conduct is carried out following the guidelines established in the bylaws. If, after the investigation process, the Committee concludes that the employee should be held responsible in the administrative, labor, civil or criminal spheres, a copy of the investigation procedure is forwarded to the Human Resources Department so that the appropriate measures can be applied (Art. 14 of the Internal Regulations).

In 2021, with the support of the IT Department, the BDMG Ethics Committee made available on its intranet page the Booklet of Ethics in Telework and the Booklet on Moral Harassment. Both documents were made available by Conset - Minas Gerais Ethics Council.

Also in 2021, in partnership with the Compliance Department, the BDMG Ethics Committee held a lecture entitled “Behavioral Insights” and the speaker was an auditor from the Federal Comptroller General (CGU). The online event was attended by approximately 70 employees.

In 2021, the Ethics Committee received two complaints of personal conflicts that were duly dealt with and resulted in conciliation between those involved. Below is a table of complaints sent to Internal Control and the External Audit:

- Governance

- |

- Sustainability Report 2021

Whistleblower

Channels

BDMG has whistleblower channels to receive anonymous information about evidence of fraud, violation of legislation or internal regulations, the Code of Conduct, Ethics and Integrity, as well as other illicit acts which may affect members of statutory bodies, as well as evidence of illicit acts. Complaints are received on the BDMG website through the Audit Committee and the State Ombudsman's Office (OGE/MG).

It is important to note that throughout 2021 there were no reports of any alleged misconduct or irregular action by BDMG. The Bank's attention to always working in line with the legal system relating to banking principles, corporate governance and ethics meant that there were no complaints against BDMG.

Disciplinary

Proceedings

The Bank has an internal rule that deals with disciplinary proceedings, which provides: "BDMG employees, due to failure to comply with their duties or failure to observe the prohibitions imposed on them or any action or omission that constitutes labor malpractice, will be subject to one of the following: penalties provided for in the Personnel Bylaws”, observing the rules provided for in the norm. It also describes when warning or suspension penalties and the dismissal process should be applied, as well as investigation and disciplinary proceedings.

Relationship with the

state of Minas Gerais

In line with the public interest and in compliance with its corporate purpose (Bylaws, article 4, IV – The purpose of BDMG is to: (....) IV. provide advisory and technical assistance services to the direct and indirect management of the State and Municipalities and private companies);, BDMG carries out activities for structuring the privatization and demobilization of assets of state-owned companies in Minas Gerais, providing specialized advisory and technical assistance services. Among these services are scenario assessments, economic-financial assessments, legal analysis, modeling, technical assistance in the preparation and execution of asset demobilization.

Therefore, BDMG operates as partner of the State of Minas Gerais in the structuring of strategic projects, in line with the Public Policies defined by its shareholder.

- Governance

- |

- Sustainability Report 2021

Corporate

Communication

In 2021, BDMG leveraged its social communication instruments in order to protect the Bank's image and reputation, maintain internal alignment and publicize its institutional and marketing actions to Minas Gerais’ society.

For this purpose, the Communication and Marketing sector carried out advertising campaigns in online and offline media that involved the dissemination of several fronts, including the Public Notice of Municipalities, the Empreendedoras de Minas line, the Pronampe line, new products in renewable energy, balance of disbursements during the pandemic, among others. In all these actions, as a strategic guideline, we sought to add to the commercial information about each product. the institutional sense of the socioeconomic impact of BDMG - most campaigns used videos, photos and/or

testimonials from real customers of the Bank, showing how credit transformed their realities and brought more development to the State.

There was also communication directed at city halls, banking correspondents, professional associations, direct sales – customers and potential customers, with the aim of supporting the commercial area.

Continuous improvements were made to the content of BDMG's website, in order to further balance its commercial bias with institutional narratives in line with the institution's profile and strategy. One of the highlights was the creation of pages on the Public Notice of Municipalities and Sustainability, in addition to constant updates in the Micro and Small Business sections and on the home page. In 2021, BDMG continued to

- Governance

- |

- Sustainability Report 2021

In 2021, BDMG maintained its proactive and transparent approach to the relationship with the press. The Bank was mentioned in 3,366 articles captured by the clipping system, 97.3% of which were classified as positive/neutral. The focus was the Minas Gerais press, responsible for about 2/3 of the articles; 1/3 of them were published in the national press or in other states, contributing to highlight

BDMG as a relevant player in the National Development System.

From an internal point of view, 59 editions of the Report were published, in order to keep the internal public aware of the main news related to BDMG's operations, as well as to constantly bring up-to-date public utility articles on the prevention of Covid-19. Virtual meetings were also held for direct communication between the Executive Board and employees, aiming at dialogue and alignment.

Team

- Team

- |

- Sustainability Report 2021

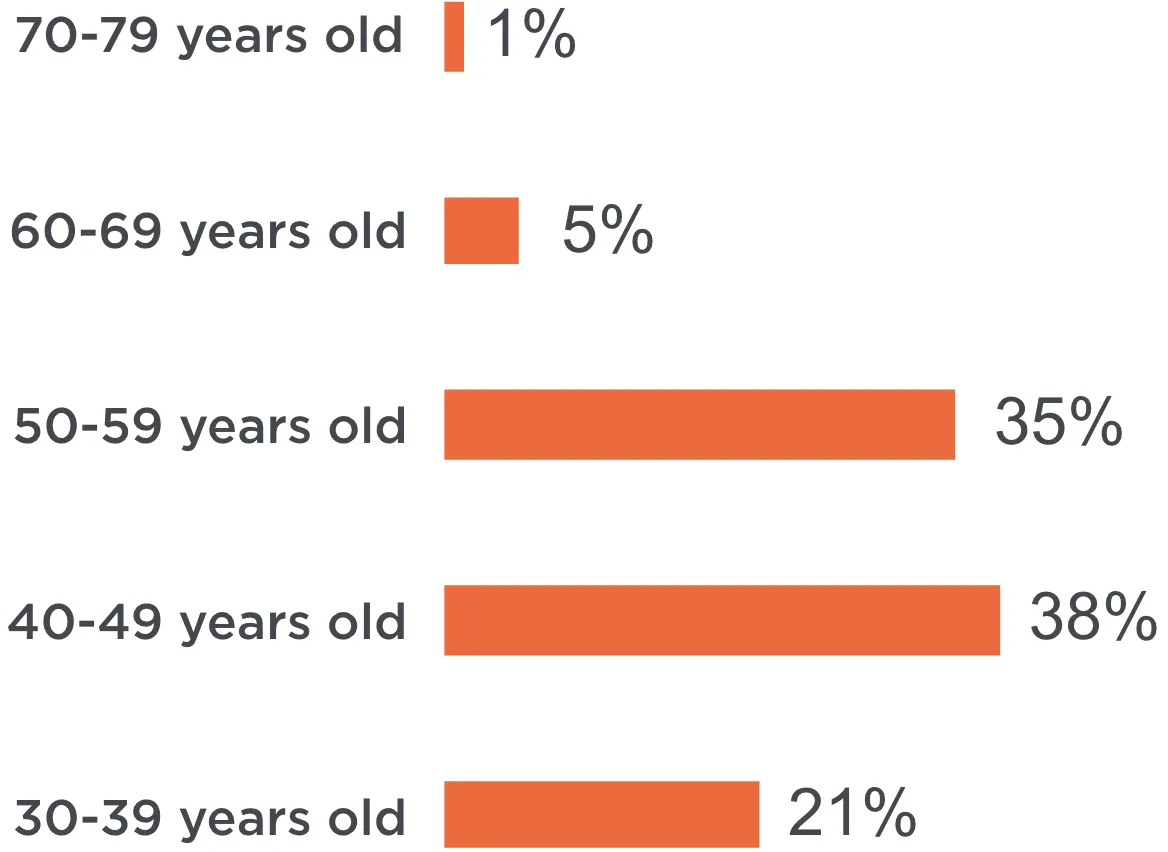

BDMG has qualified and committed professionals in the search for solutions for the development of the State of Minas Gerais. At the end of 2021, the Bank had a team of 328 employees, of which 2952 permanent employees were hired through public tender and 33 were appointed to broad recruitment positions, linked to the Executive Board's mandate.

Of the total number of career employees, admitted through public tender, 76% have a doctorate, master's or graduate degree, and their main areas are: Administration, Engineering, Economics, Accounting, Systems Analysis and Law.

2 14 employees are on loan or have suspended contracts.

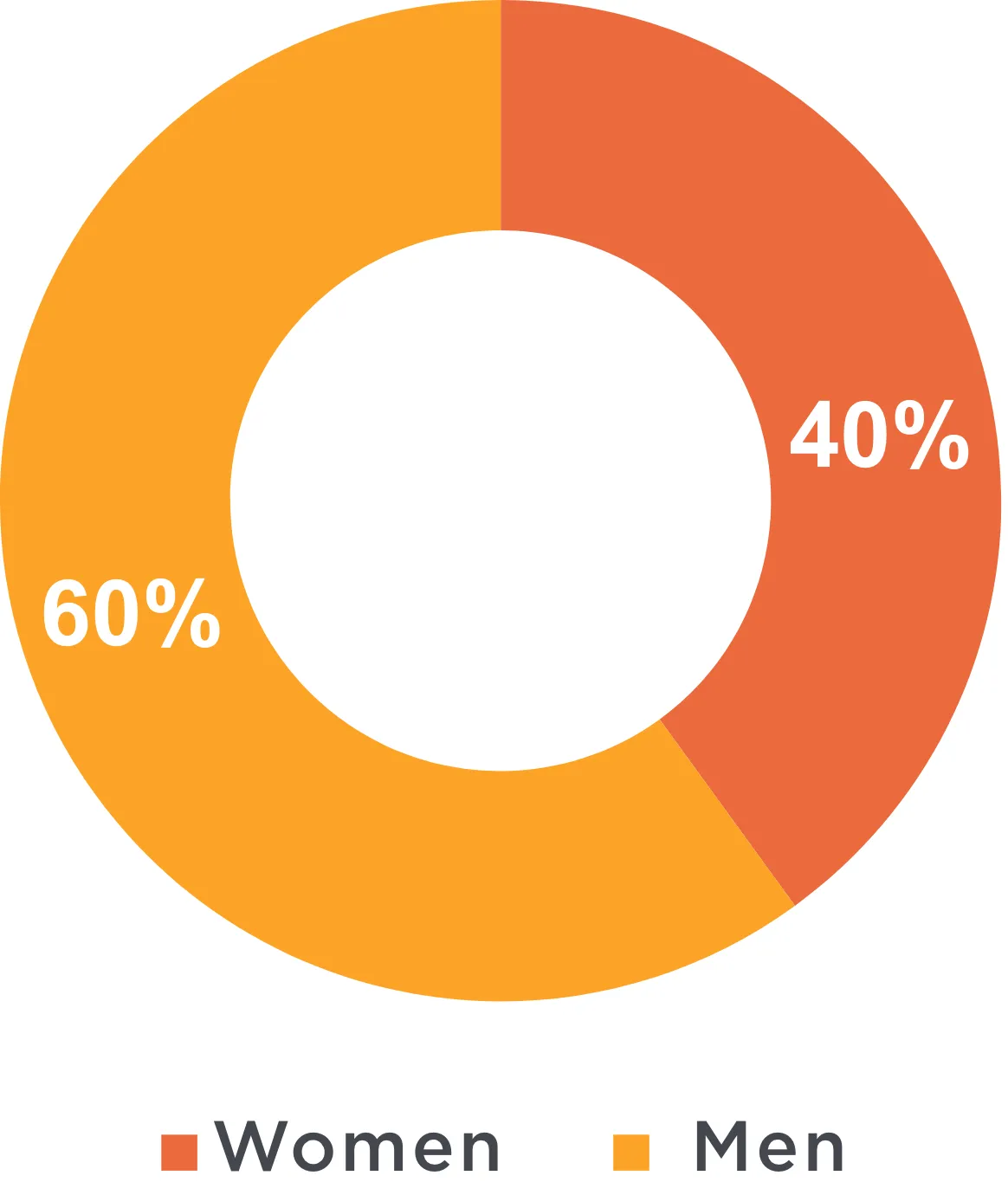

Employees Admitted

Through Public Tender

since 2021

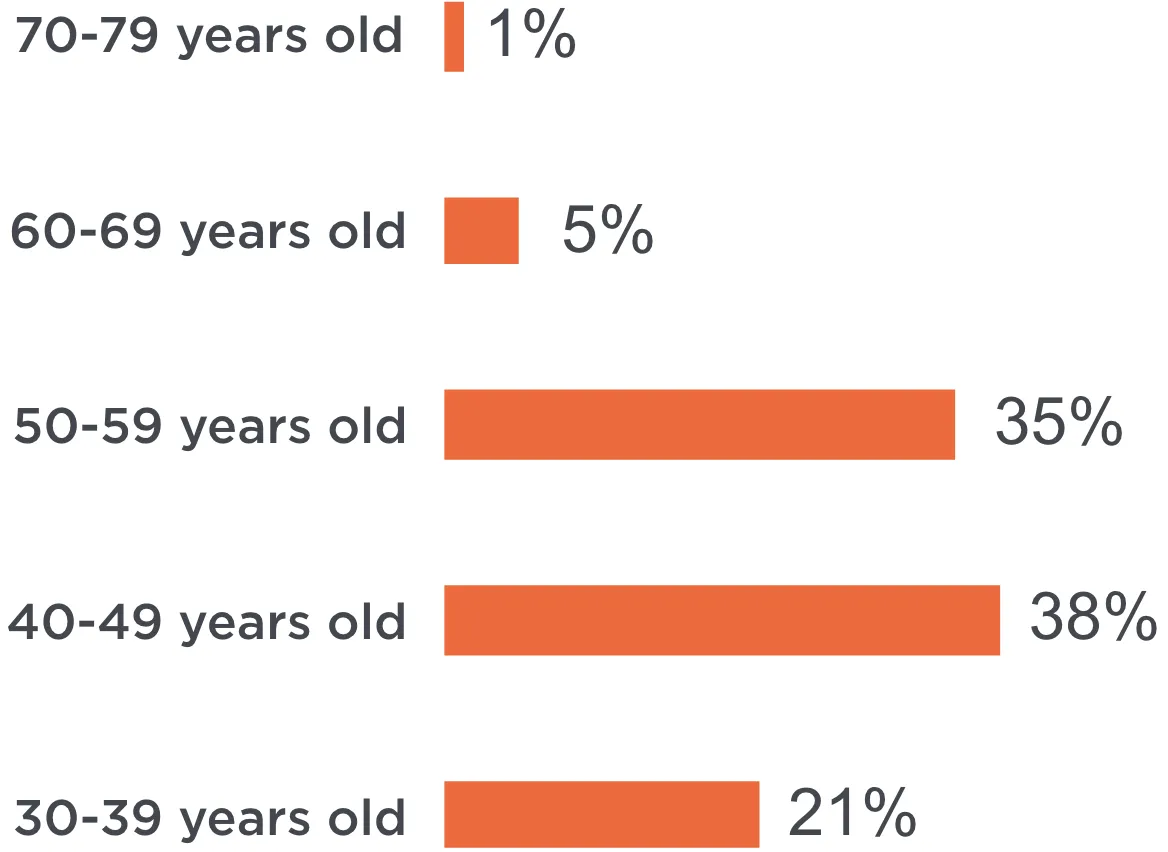

Age Group of

BDMG Employees

Since 2021

- Team

- |

- Sustainability Report 2021

BDMG Employees’ Level of Educatio

Since 2021

| Education level | Nº | % |

|---|---|---|

| Doctoral degree | 9 | 3 |

| Master’s degree | 33 | 11 |

| Graduate | 184 | 62 |

| Undergraduate | 64 | 22 |

| High School | 5 | 1 |

| Total | 295 | 100 |

Source: Internal Data

The BDMG team also has 105 interns and apprentices from the Learning Program and 148 employees from outsourced teams who provide services which are not typical of BDMG careers, such as: building maintenance and general services, IT services, project analysis engineering, administrative services.

People Management

Policies

The people management strategy intends to ensure that BDMG has qualified professionals engaged around the organizational strategy, in continuous development, in a productive, safe and healthy work environment, with knowledge of the business aspirations and involvement in the strategy and transformation of the institution.

BDMG adopts a people management model based on competencies, which promotes the alignment of management processes with the organizational strategy, creating means that enable the commitment of individuals and groups to the organization's objectives. In this sense, the essential competencies for implementing the strategy were defined, which serve as a subsidy for all personnel processes and policies:

BEHAVIORAL

COMPETENCIES

- • Adaptability

- • Effective Communication

- • Systemic vision

- • Protagonism and leadership

TECHNICAL

COMPETENCIES

- • Economic Impact, social and environmental vision

- • Specialist in the State of Minas Gerais

- • Bank Finances

- • Market Vision

- • Data Analysis

- Team

- |

- Sustainability Report 2021

Health

and Safety

Aware of the effects of the crisis created by the COVID-19 pandemic, since March 2020 BDMG has established and updated preventive measures to preserve the health of all employees, partners and customers. The Bank has adapted its dynamics and processes to the telework (remote) regime, preserving its ability to serve its customers in an uninterrupted manner.

Since 2001, BDMG promotes actions aimed at the integral health and well-being of employees, through BDMG Envolve.

In 2021 the Bank adapted and modernized its Health and Safety Program – BDMG Envolve - seeking to support employees in teleworking in the pandemic context. Among these actions, BDMG implemented online gymnastics, enabling greater closeness and interaction with postural reeducation teams,

and made available the BDMG Envolve platform with content and guidelines on ergonomics, mental health, among others. Once again, the Bank ensured flu vaccination for all employees, interns and outsourced staff.

A highlight in 2021 was the Healthy Mind Program, in partnership with DESBAN and Gattaz, Health & Results, focused on preserving the mental health and supporting the emotional well-being of all employees. Several training actions were carried out involving managers and teams, such as workshops, assessments and online services for all employees.

Other actions of the program, such as the vocal group, activities in the Envolve space and food reeducation were interrupted due to the Covid-19 pandemic.

Telework

Telework

With the COVID-19 pandemic, 85% of BDMG's workforce, including employees, interns and outsourced teams, started working remotely.

Internal surveys showed that employees and managers were pleased with the remote work experience and that productivity and interaction with teams remained satisfactory. At the end of 2020, considering the successful experience, cost reduction and in tune with global movements to change the work regime of companies, a New Telework Policy was approved.

In 2021, a participatory process was carried out to implement this new model (as of February 2022), in line with BDMG's needs, employee profile and nature of activities. Also in 2021, several studies were started on layout adjustments in order to modernize the work infrastructure, considering hybrid (remote and in-office) work.

- Team

- |

- Sustainability Report 2021

Continuous

Development

The objective of the training and development activities made available by BDMG is training employees to do their duties, as well as contributing to attaining organizational and unit goals.

In 2021, BRL 751 thousand were invested in training 131 employees. Three structuring programs were launched, addressing the following topics: English language, with the objective of increasing the proficiency of employees who work directly with international negotiations; graduate and MBA courses focused on the development of essential competences within the scope of BDMG's strategy; and a Leadership course to prepare managers and analysts with a leadership profile to play their decisive roles in achieving strategic goals and objectives.

sides these training courses, 185 employees attended courses,

Continuous

Development

lectures and seminars that addressed topics, such as Banking Finance – Exchange, ALM, Effective Communication, Risk Management, Credit Recovery, Administrative Law, Ombudsman, LGPD.

Three training courses were held in partnership with the Brazil Green Finance Programme of the UK PACT, which involved the participation of 119 employees: Carbon Market training, Linked Bonds training and a Women's Leadership workshop. The Brazil Green Finance Programme aims to boost investments in sustainable infrastructure projects to support low- carbon economic development in Brazil, contributing to the fulfillment of its NDCs3 targets under the new Global Compact.

With regard to mandatory training, all permanent employees, interns, outsourced workers and the Board of Directors had training

Continuous

Development

on LGPD and Online Information Security topics, given by internal personnel and specialized institutions for the Prevention of Money Laundering and Terrorism.

Another development action carried out by the Training and Development team is the monitoring of free materials, sending to all employees from time to time a newsletter with a selection of courses, activities and content, in order to contribute to the continuous improvement of the intellectual capital of the teams, in line with BDMG's strategic guidelines, purpose and values. In total, 53 pieces of content were shared in different formats on the following topics: Technology, Data Science, Agile Methodologies, Leadership, Finance, Communication, soft skills, among others.

3English acronym for Nationally Determined Contribution, are the targets stipulated by a non-binding national plan that highlights the mitigation of climate change so that each country can contribute to the reduction of CO2 emissions.

- Team

- |

- Sustainability Report 2021

Internship and

Apprenticeship Program

In 2021, BDMG restructured its Internship Program in order to achieve greater alignment with business needs, maximizing the impact on the student's career, promoting inclusion and diversity in the work environment and achieving greater efficiency and cost management.

The BDMG Internship Program promotes integration between the Bank and educational institutions, as well as encourage teamwork and the exchange of experiences between students and BDMG professionals. The program offers opportunities

for students and higher-level students in Business Administration, Accounting, Law, Economics, Engineering, among others.

The Apprenticeship Program, on the other hand, promotes the personal and professional development of teenagers, facilitating their insertion into the formal job market and providing the acquisition of habits, experiences and attitudes that are essential for human and social training. The program only covers the Minor Apprentice modality and the total number of apprentices is limited to 15% of the development technicians who do not occupy a position of trust in BDMG.

- Team

- |

- Sustainability Report 2021

Diversity

and Inclusion

Seeking to contribute to the 2030 Agenda in terms of gender equality and reducing inequalities, as of November 2021, BDMG established new socioeconomic and gender criteria in the selection process to expand opportunities for women and young people from public schools and beneficiaries of government programs in the BDMG Internship Program. Among the interns, 49% are women.

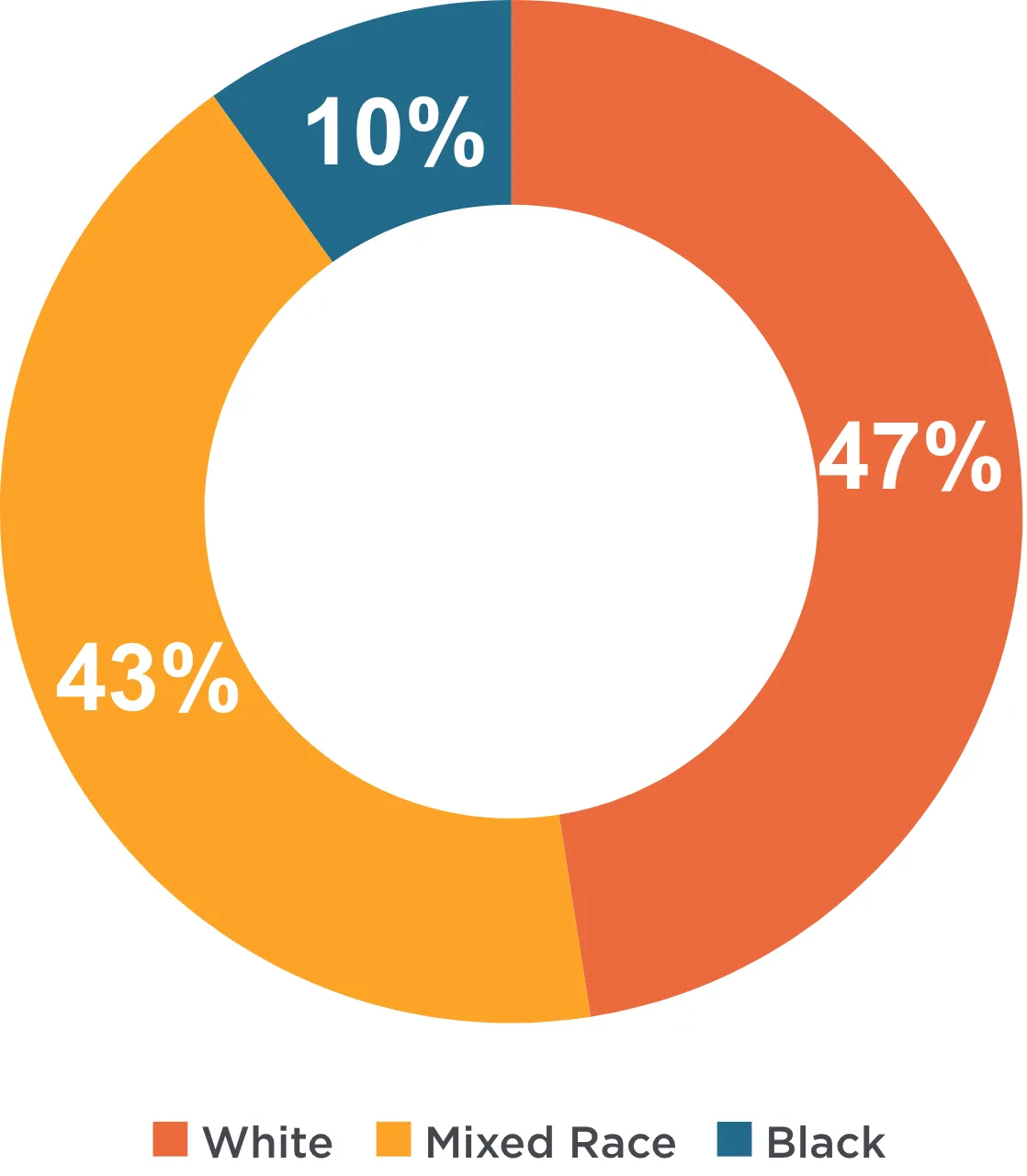

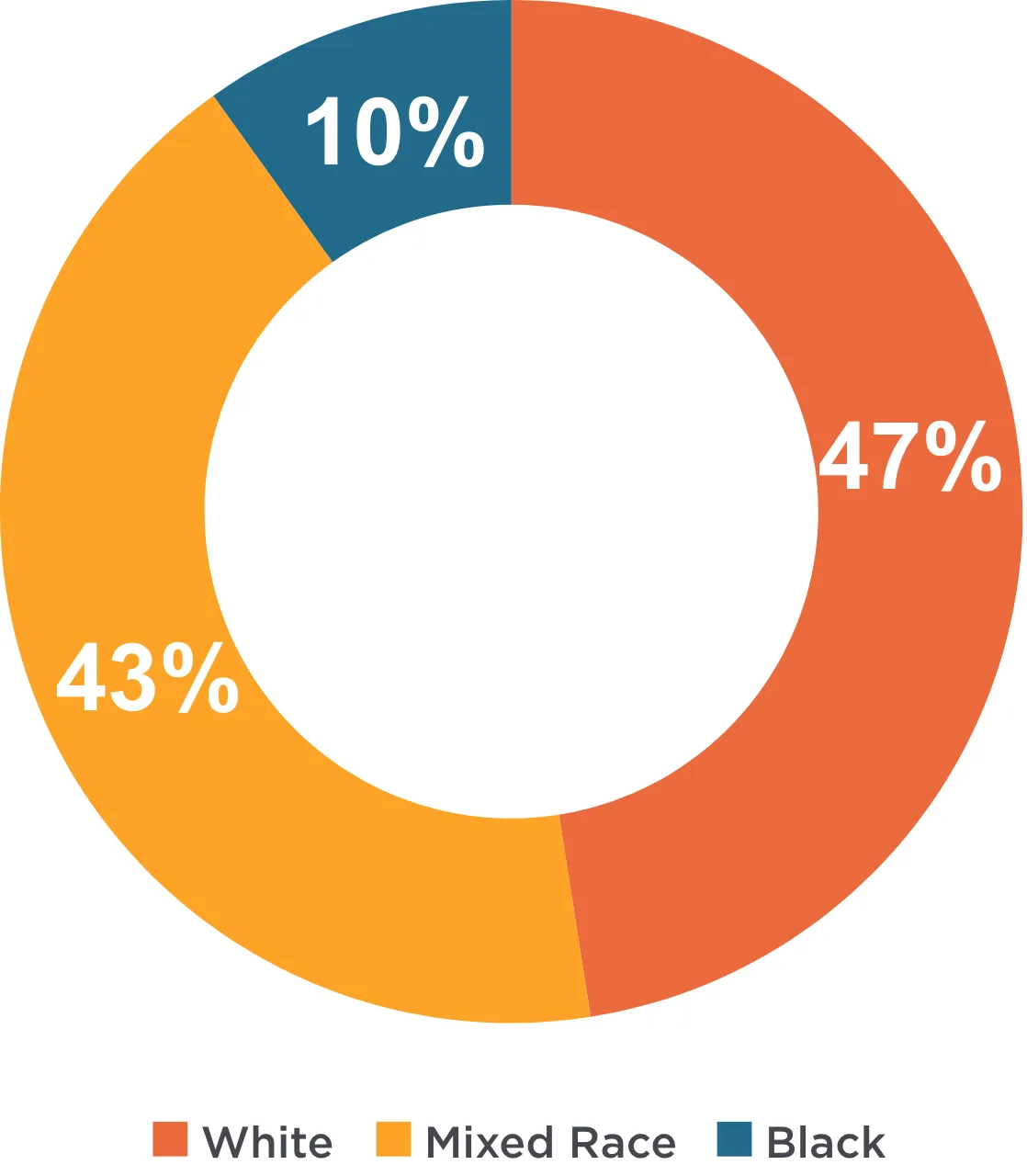

Diversity among BDMG interns

Disabled - Interns

Interns by race

- Team

- |

- Sustainability Report 2021

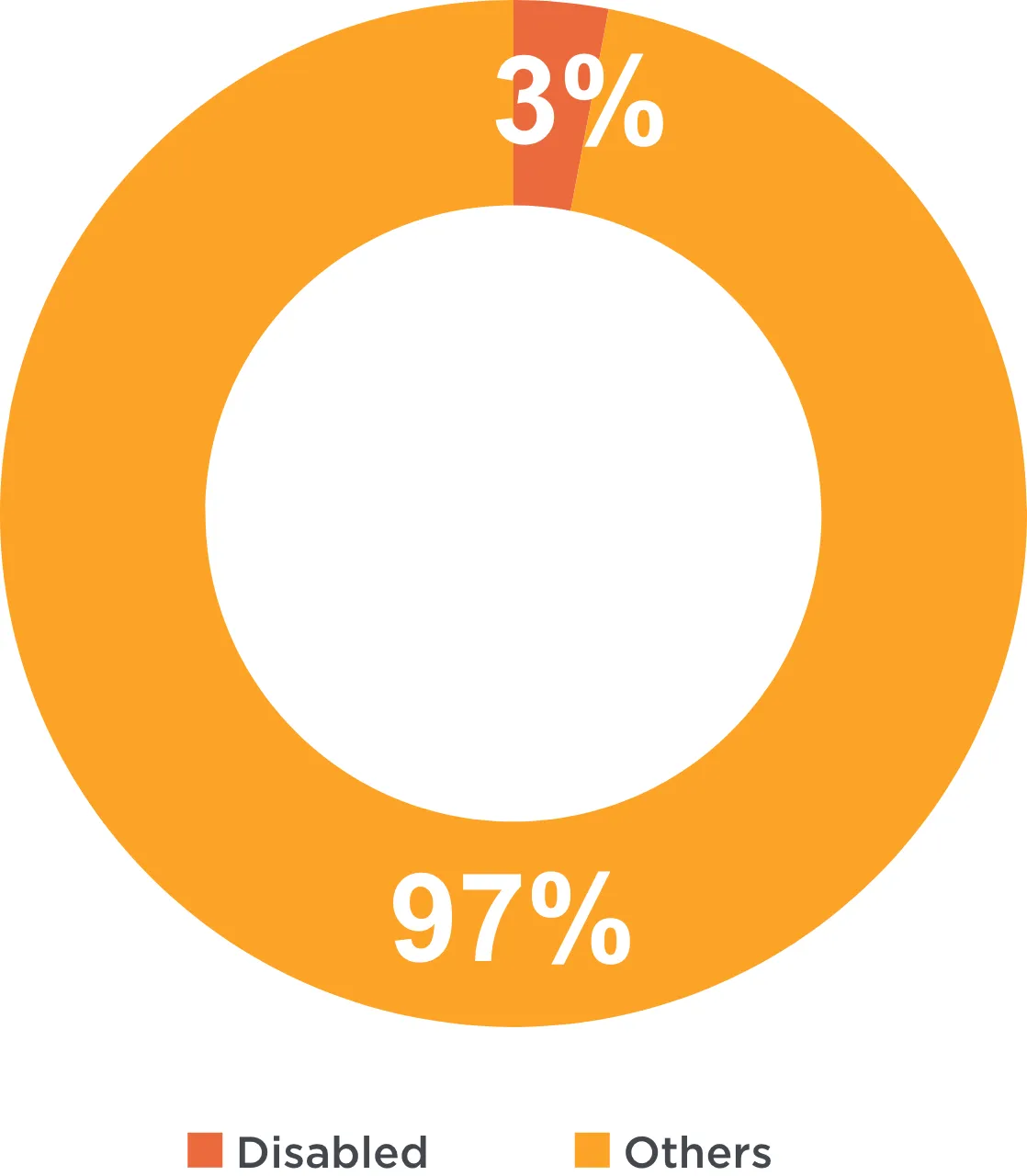

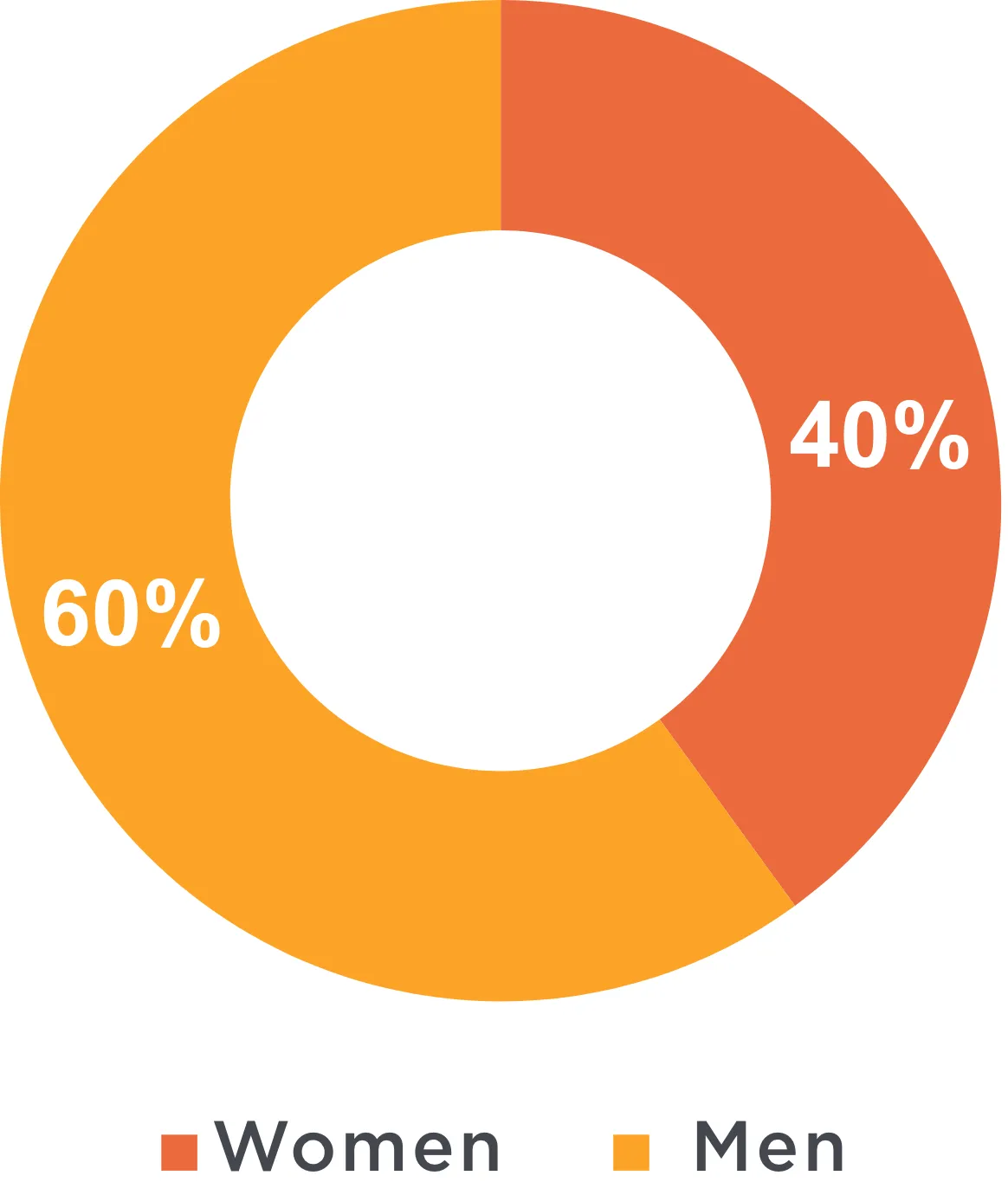

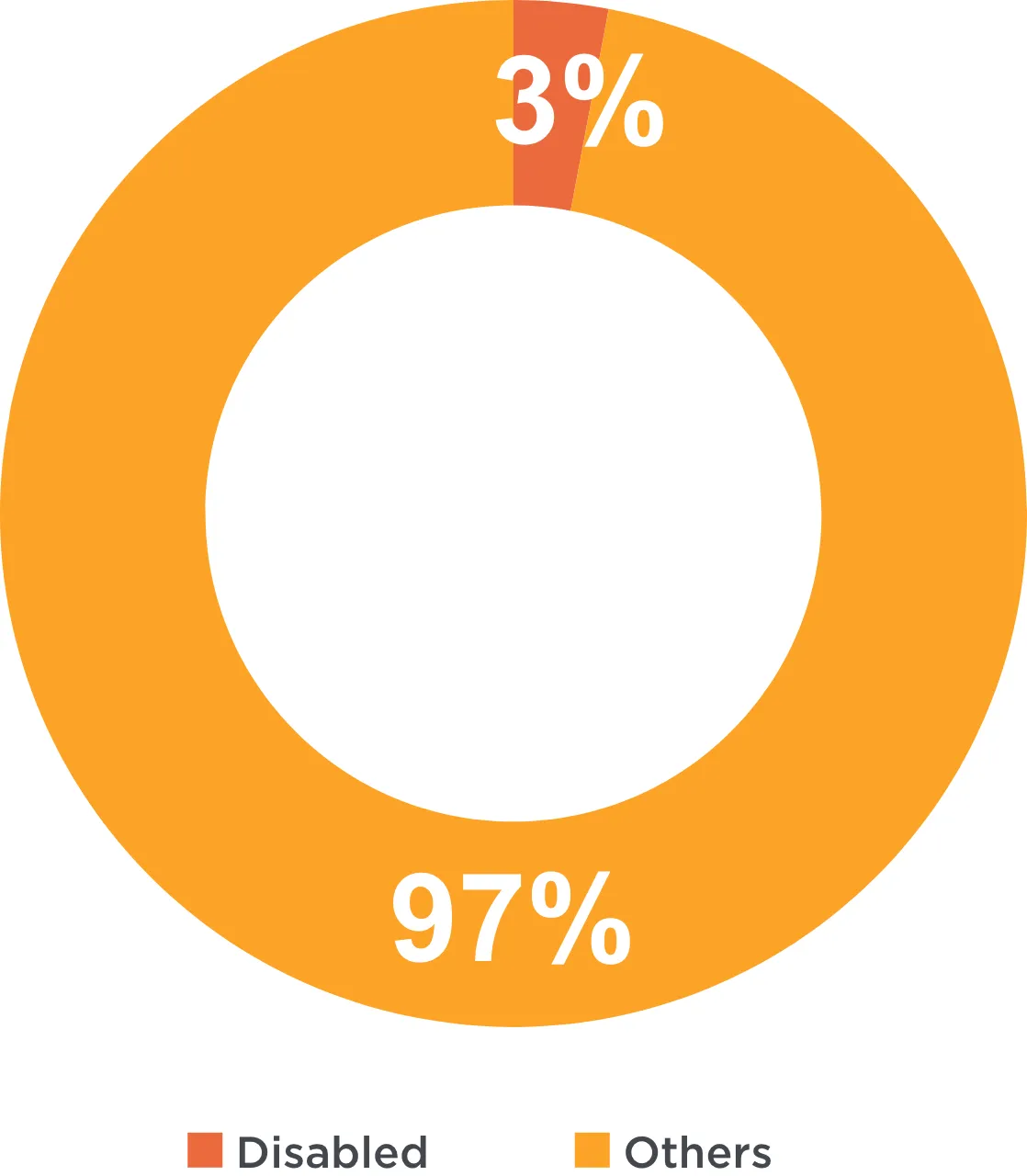

With regard to employees, as a public institution, admissions are carried out through a public tender, and therefore, the inclusion criteria are limited to those permitted by federal and state legislation. However, management positions have a more balanced gender distribution. Women account for 40% of the general staff and 47% of management positions.

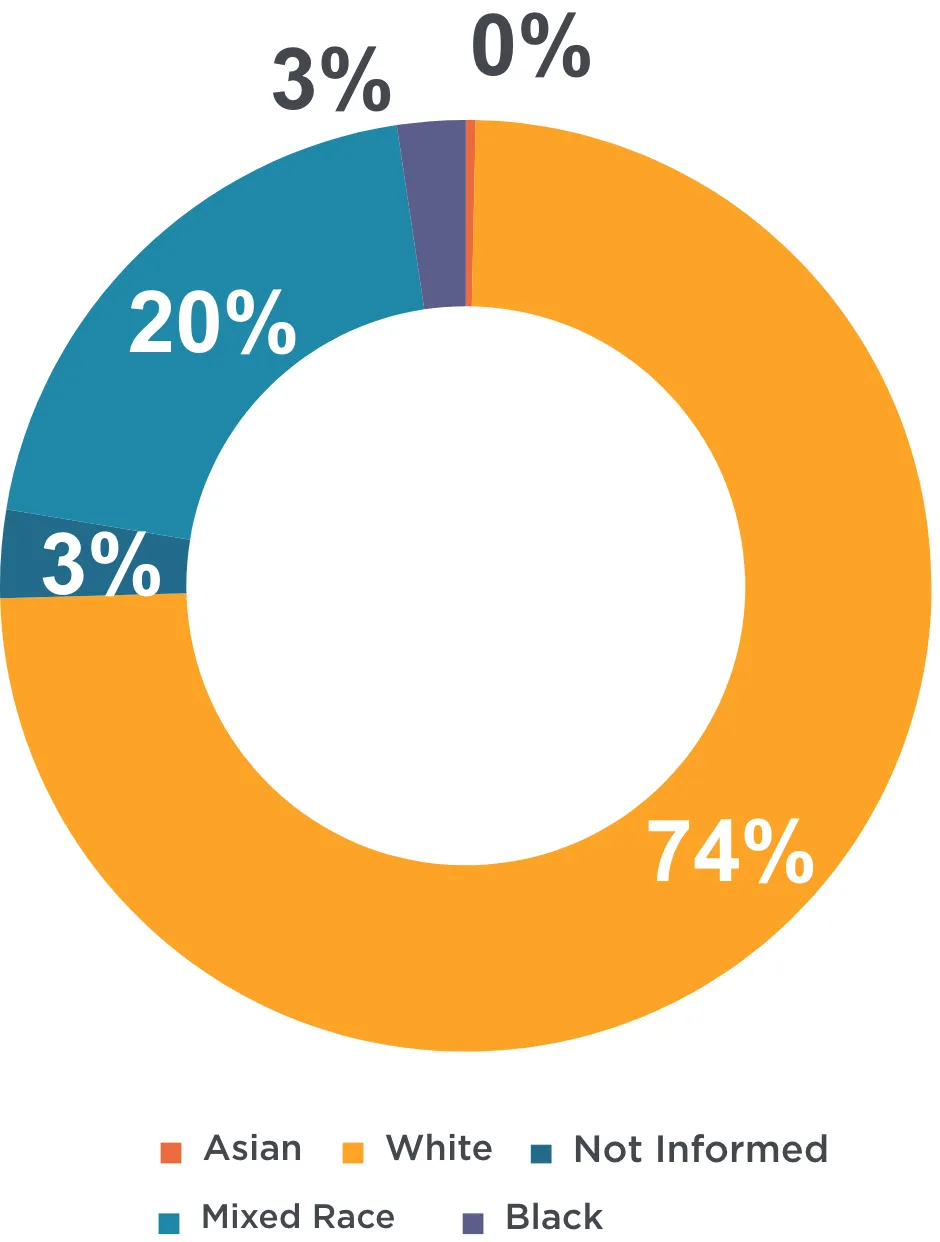

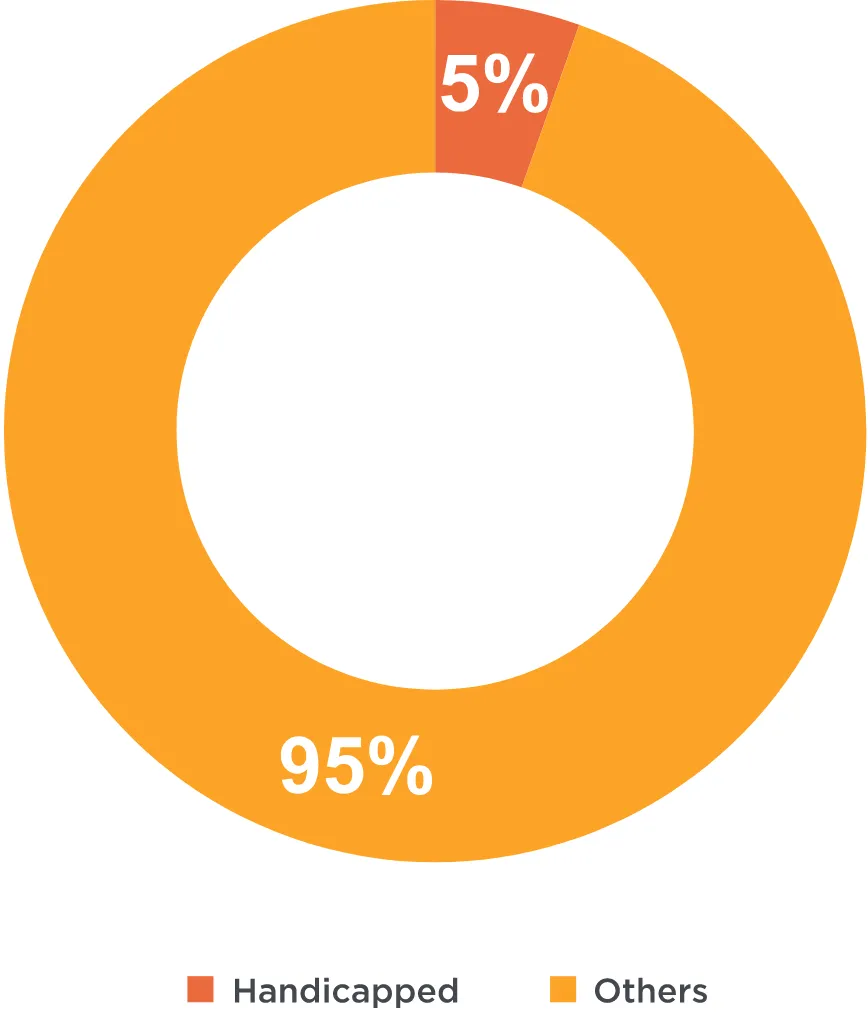

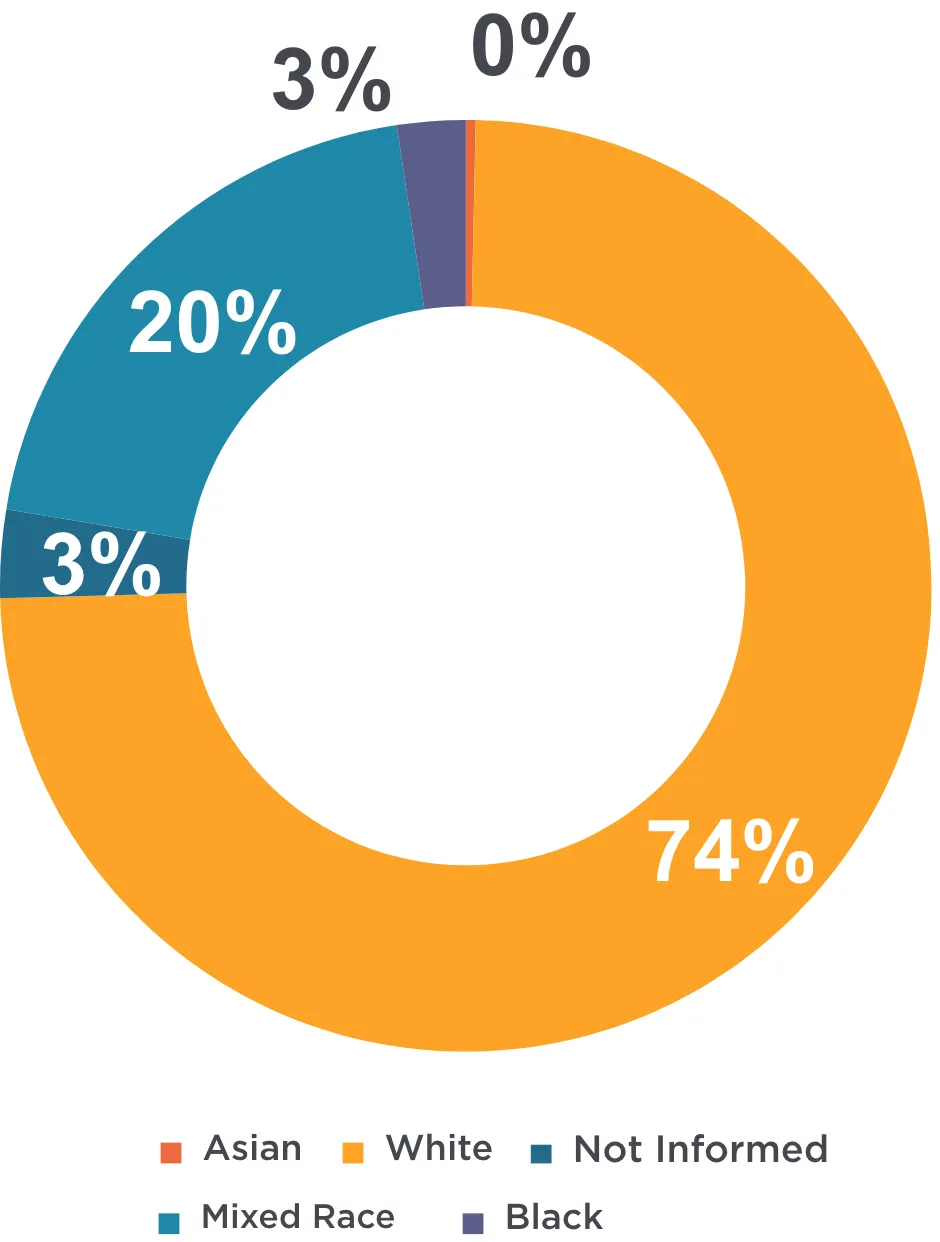

Diversity among BDMG employees:

Race/ethnic group

- Public Emplyees

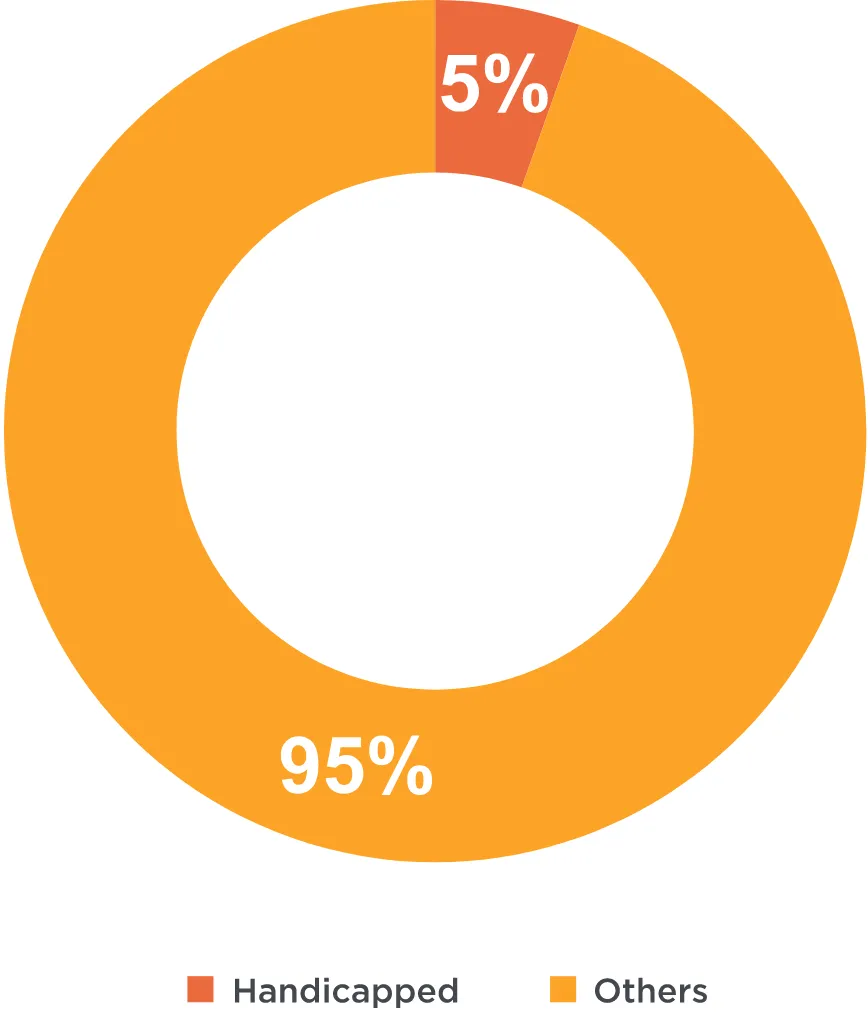

Handicapped

- Public Emplyees

- Team

- |

- Sustainability Report 2021

Benefits

provided

Private Pension

In order to assure that employees receive supplementary retirement payments above the pension granted through the General Social Security System – RGPS, BDMG sponsors the supplementary pension plans managed by the BDMG Social Security Foundation – DESBAN.

Health Care Plan

The Health Plan provided by the BDMG Social Security Foundation – DESBAN provides dental, outpatient and hospital coverage to its users and dependents, and is funded by BDMG, DESBAN and by active, assisted and self-sponsored users.

Occupational physicians

BDMG has an Occupational Medicine service at its premises, whose attributions are to carry out admission, dismissal, periodical and return-to-work medical examinations, in addition to monitoring the control of absences caused by health issues.

- Team

- |

- Sustainability Report 2021

Extended Maternity and Paternity Leave

BDMG is a participant in the Empresa Cidadã Program, providing an extension of maternity leave by 60 days (total of 180 days) and paternity leave by 15 days (total of 20 days) in cases of birth or adoption. Benefits related to maternity and paternity leave are provided to all employees, including those who declare homosexual relationships.

Internal Committee

for Accident

Prevention - CIPA

Considering that the Bank does not have considerable chemical, physical and biological risks, CIPA BDMG focuses on ergonomic risks and accidents, as well as on activities to promote the health of employees. In 2021, CIPA's actions were aimed at encouraging the participation of employees in online gymnastics activities, in view of the remote work regime; support the People Management Superintendence in the implementation and dissemination of the Mental Health Program and support the development and implementation of the Health and Safety Platform, in partnership with BDMG Envolve; among others.

In the pandemic context, CIPA maintained the calendar of monthly meetings and constant dialogue with the Superintendence of Personnel Management on issues related to the fight against Covid-19, and the president of CIPA became a member of the BDMG “COVID Committee”, as of March 2021. In September, CIPA promoted the Internal Week for the Prevention of Accidents at Work - SIPAT, focusing on the theme "Myths and Truths about mental health", which featured expert speakers in the area and had significant participation of employees.

Performance

- Performance

- |

- Sustainability Report 2021

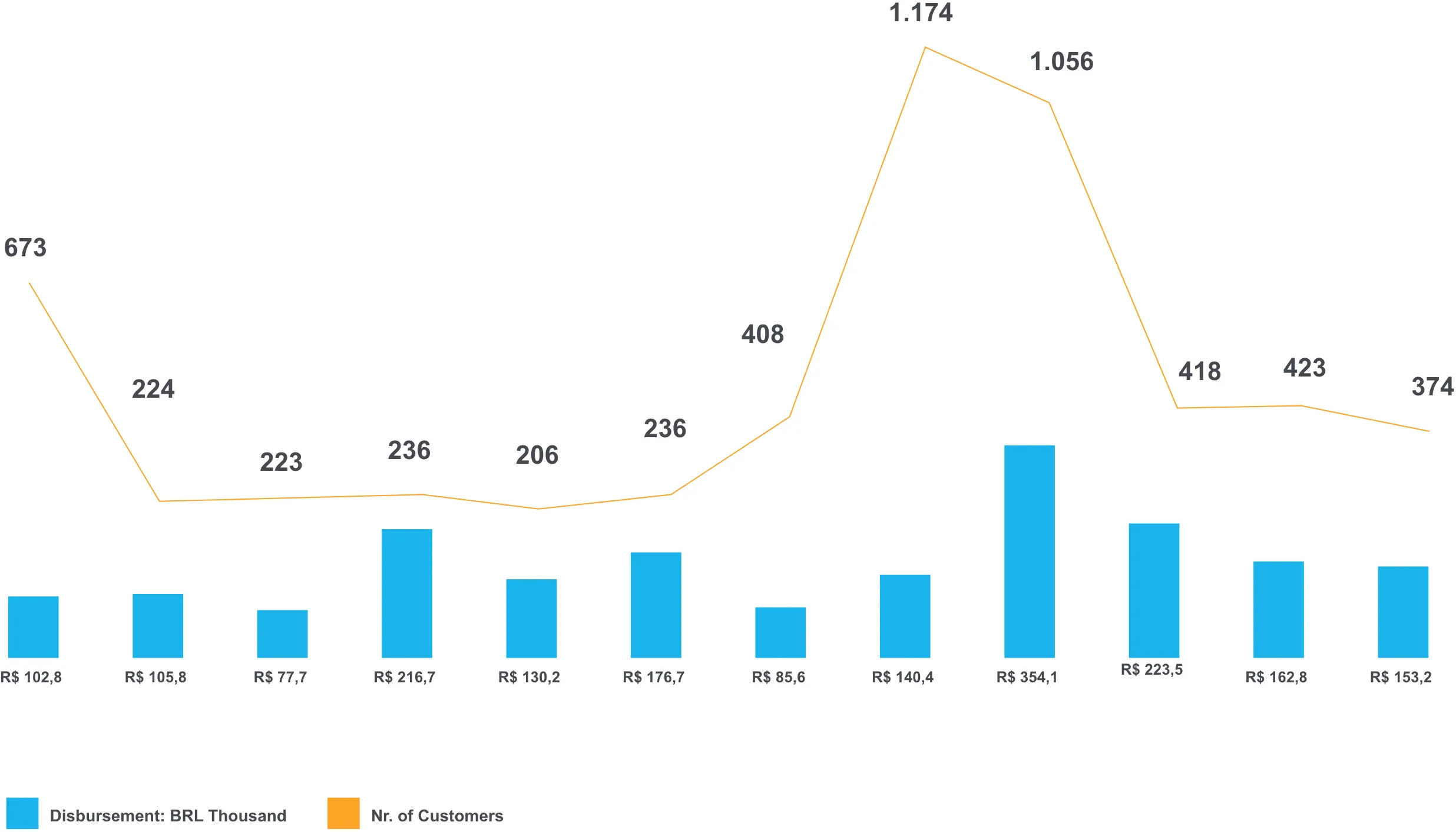

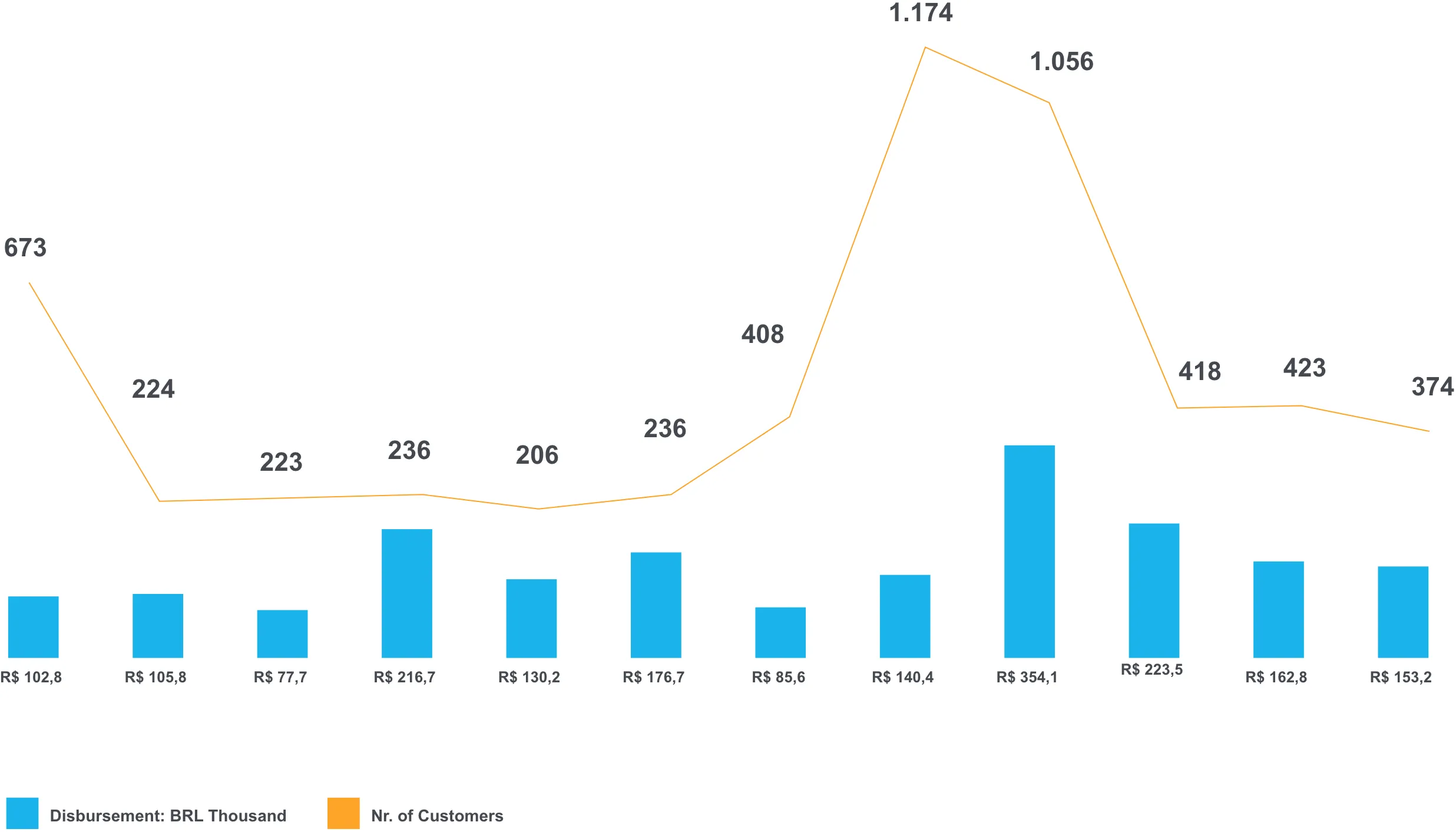

The total disbursement in 2021 was BRL 1,929.7 million, serving 4,918 private and public customers. Compared to the 2020 disbursement, there was a decrease of 32%, which reflects the implementation of emergency credit programs at the time of the outbreak of the COVID crisis. Considering the entire pandemic period, BDMG invested BRL 4.6 billion in the Minas Gerais economy, contributing to the strengthening, recovery and overcoming this adverse scenario, serving 16,449 customers between March 2020 and December 2021.

Monthly Disbursements

and Number of Customers

in 2021 – Monthly

- Performance

- |

- Sustainability Report 2021

Analyzing disbursements by company size4 in 2021, BRL 311.9 million were allocated to 4,522 micro and small companies, which represents 92% of the number of customers served by BDMG in the period. BRL 586.6 million was disbursed for 153 medium-sized companies, while for 49 large companies, the amount was BRL 933.6 million. As for the public sector, BRL 91.8 million was disbursed for projects in 203 municipalities. Another BRL 5.7 million was allocated to investments in Investment and Participation Funds (FIP).

As for the origin of funds disbursed in the year, 65.4% came from own funds and/or from domestic and international funding;

33.2% were transfers and 2% from funds. The sources of funds that stood out in the period were: Letters of Credit for Agribusiness (LCA), accounting for 24.2% of the total disbursement; and the Coffee Economy Defense Fund (FUNCAFÉ), with 22.5%. The products of the National Bank for Economic and Social Development (BNDES), as well as those of the National Support Program for Micro and Small Businesses (PRONAMPE), also showed good results, both accounting for 9.5% of total funds transferred.

4 Classification of the size of companies in BDMG: Micro and Small Companies: gross annual revenue lower than or equal to BRL 4.8 million; Average: greater than BRL4.8 million and less than or equal to BRL300 million; Large Companies, above BRL300 million.

- Performance

- |

- Sustainability Report 2021

Disbursements

in 2021 –

By source of funds

| Source | Disbursement (BRL thousand) |

% | |

|---|---|---|---|

|

Own Funds 65,4% |

|

|

|

|

Transfers 33,2% |

|

|

|

|

Funds 1,4% |

|

|

|

| Total | 1.927,0 | 100,0 |

* BDMG DIGITAL, SAÚDE, BD FIXO, FIPs and EQUITY, FAPEMIG, BDMG and CARGIL/LCA

- Performance

- |

- Sustainability Report 2021

The sectors that stood out in terms of disbursement volume were Commerce and Services, with BRL 1,002 million, or 52% of the total. The Transformation Industry appears in second place, with 26% of disbursements or BRL 92.1 million, followed by the Agriculture, Livestock and Forestry sector, which accounted for 11%, with BRL 213.2 million.

Sectoral distribution of BDMG disbursements –

Comparative 2020-21 (in BRL millions)

| Sector | 2020 | % | 2021 | % |

|---|---|---|---|---|

| Commerce and Services |

|

|

|

|

| Transformation Industry |

|

|

|

|

| Agriculture, livestock and forestry |

|

|

|

|

| Public Utility Industrial Services |

|

|

|

|

| Construction |

|

|

|

|

| Mining industry |

|

|

|

|

| Investments in FIP |

|

|

|

|

| Total | 2.849,5 | 100 | 1927,7 | 100 |

Source: Internal Data

- Performance

- |

- Sustainability Report 2021

Disbursement

by Macroregion

On the regional distribution of the disbursed volume, BRL 1,223 million (69%) were allocated to the Central, South Minas and Triângulo Mineiro macroregions. The North, Northwest and Jequitinhonha regions received disbursements of BRL 153.1 million (8%). Other macro-regions received BRL 365.6 million of the total volume released (21%), as shown in the table below.

Distribution of Disbursements in 2021 -

– by Macro region

| Macroregion | 2020 | % | 2021 | % |

|---|---|---|---|---|

| Central |

|

|

|

|

| South Minas |

|

|

|

|

| Triângulo Mineiro |

|

|

|

|

| Alto Paranaíba |

|

|

|

|

| Zona da Mata |

|

|

|

|

| North Minas |

|

|

|

|

| Central-West Minas |

|

|

|

|

| Rio Doce |

|

|

|

|

| Northeast Minas |

|

|

|

|

| Jequitinhonha |

|

|

|

|

| Subtotal |

|

|

|

|

| Other states and investments in FIP |

|

|

|

|

| Total | 2.849,5 | 100 | 1927,7 | 100 |

- Performance

- |

- Sustainability Report 2021

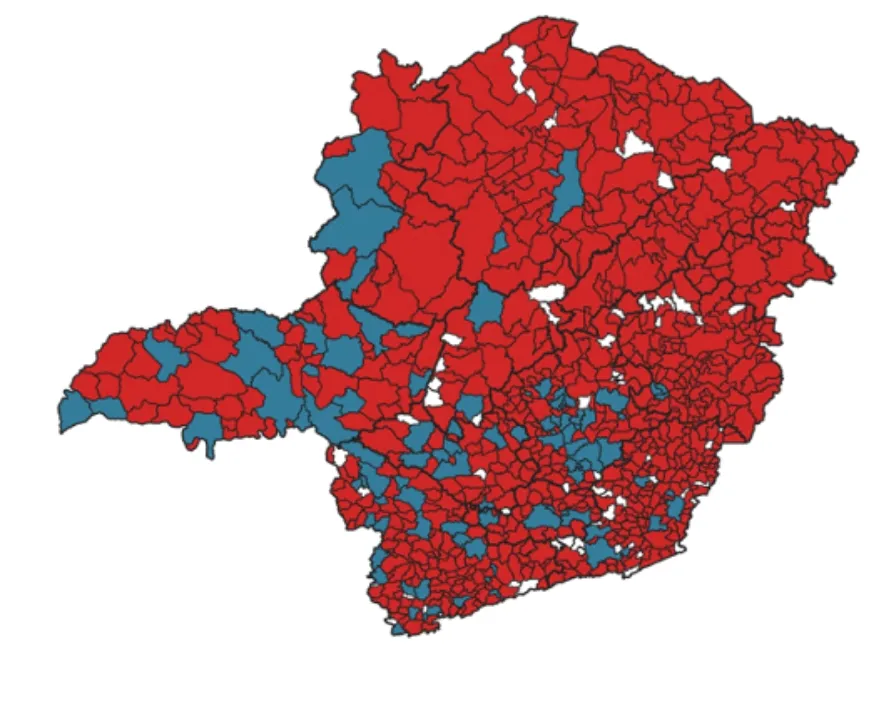

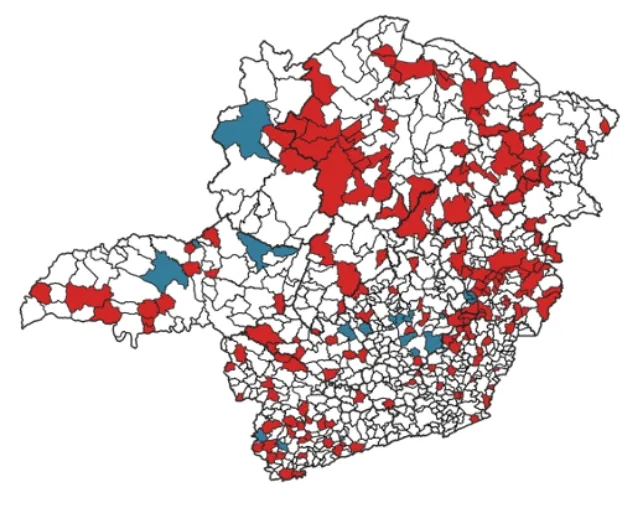

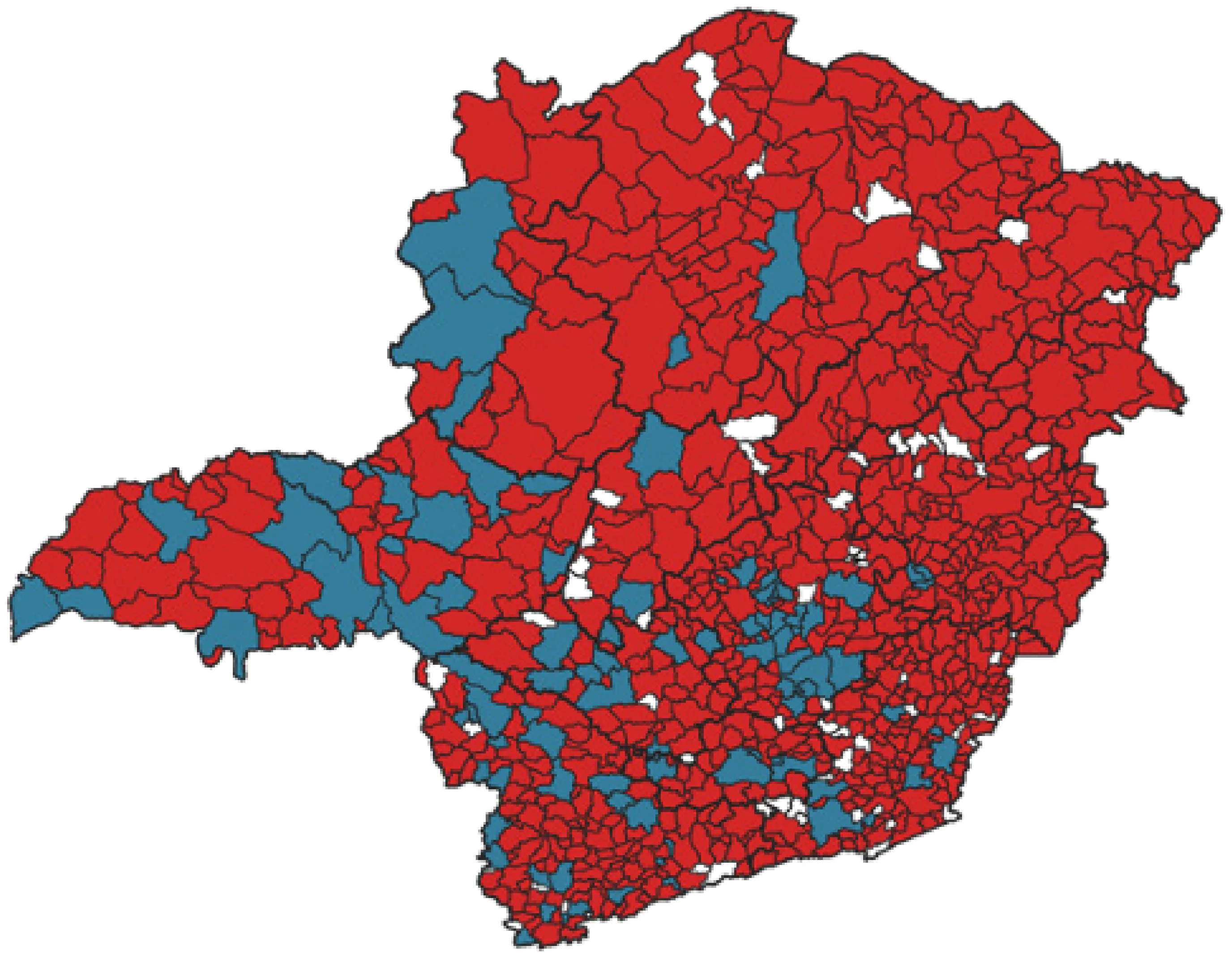

Companies and Town Halls served in 2021 are from 526 municipalities, 432 of them (82%) showing a Human Development Index (HDI)5 below the Brazilian average 5. 39% of the total invested in the North region was directed to photovoltaic solar energy projects, contributing to the growth of renewable energy projects in the region.

With at least one active contract in 793 of the 853 municipalities in Minas Gerais (93%), BDMG has operated with capillarity, benefiting all regions of the State in generating relevant socioeconomic impact.

The active portfolio of BDMG had a balance of BRL 5.8 billion at the end of the year, showing a decrease of 3% compared to the same balance in 2020, and 29,322 customers, compared to 29,170 in the previous period.

BDMG presence in the municipalities of Minas Gerais, according to HDI (Dec/21)

5 The Human Development Index (HDI) measures a nation's progress along three dimensions: income, health and education. The Brazilian average used was 0.728 (2011). Source: https://www.br.undp.org/

- Performance

- |

- Sustainability Report 2021

RESPONSE

TO COVID-19

BDMG has worked effectively, technically and within the best practices of national and international banking governance in supporting the various sectors of the Minas Gerais economy affected by the Covid-19 pandemic. Through financing lines, including those created or adapted to support the sectors most affected by the crisis, from the beginning of the pandemic6 until December 2021, BDMG has already disbursed over BRL 4.6 billion to 16,449 customers in 710 municipalities in Minas Gerais.

During this period, the sectors that received special attention from the BDMG were: the production chain of health care, tourism and micro and small companies. BDMG Pronampe was the product that served the largest number of SMEs, disbursing BRL 854.9 million to 12,189 customers.

6 March 2020, when the World Health Organization (WHO) declared the pandemic.

- Performance

- |

- Sustainability Report 2021

AGRIBUSINESS

In 2021, 49% of the total disbursement was directed to agribusiness. That is, BRL 949.9 million in financing carried out mainly through lines that use resources based on Letters of Credit for Agribusiness (LCA), Funcafé and BNDES. Disbursements linked to the LCA lines were BRL 466.5 million, or 49% of the total allocated to the agribusiness sector - a slight decrease of 1% compared to 2020. This year, new exclusive lines of credit were created for agribusiness, ranging from small rural producers to exporting companies and cooperatives.

- Performance

- |

- Sustainability Report 2021

Funcafé

Among the funds invested in agribusiness, Funcafé accounted for 46% of the disbursement to the coffee chain (BRL 434 million), a reduction of 4% compared to the previous year. For the 2020/2021 Crop Year, BDMG operated with the largest amount of credit to the coffee sector in its history: BRL 462.5 million, fully disbursed. For the 2021/2022 Crop Plan, the amount made available is BRL 355.5 million, of which BRL 276.4 million, or 77%, has already been disbursed. This is the 2nd largest budget of the fund in Brazil, behind only a bank with national operations.

Support for Rural Producers: New Fronts

In June, a partnership agreement was signed for the implementation of a pilot project with Cresol Minas – Rural Credit Cooperative with Solidarity Interaction of Minas Gerais. The cooperative started operating as a financial agent, transferring funds from BDMG and allowing the Bank to increase its reach to rural producers of different sizes, acting as a second tier bank. Until December, BRL 2.3 million had been transferred.

In July, the BDMG Agro Exportação line was launched to provide financial support to exporting companies in the agribusiness chain, valuing Minas Gerais production in the international market. By December 2021, BRL 59 million had been transferred.

BDMG also started to directly access funds from the Ministry of Agriculture, Livestock and Supply (MAPA) to operate lines of the 2021/2022 Crop Plan at BRL 22.8 million.

- Performance

- |

- Sustainability Report 2021

PUBLIC SECTOR

In 2021, BDMG guided its strategy to provide credit to the public sector online, via the BDMG Digital Platform, with a reference limit of BRL 5 million for each municipality, together with other limits, according to the size of the population.

During the year, BRL 91.8 million was disbursed for projects in 203 municipalities in Minas Gerais, and 93% of the total amount disbursed was aligned with at least one of the Sustainable Development Goals. The diversification of credit achieved through the Public Notice and other lines allowed BDMG to maintain its position as the financial agent with the highest number of operations, granted by the National Treasury Department: 83% of operations in Minas Gerais in 2021. From the outlook of the global financial value of operations, BDMG was in second place, after a bank with national operations.

- Performance

- |

- Sustainability Report 2021

BDMG MUNICÍPIOS 2021

PUBLIC NOTICE

In April 2021, BDMG launched a new Public Notice of financing for the public sector, making funds available through 4 lines: Urbaniza (urban infrastructure), Sustainable Cities (clean energy, modernization of public buildings), Sanitation (water, sewage and solid waste) and Maq (machinery, equipment and vehicles). A total of 261 municipalities were awarded new contracts without a guarantee from the Union, totaling a volume of BRL 387 million in credit that will enable new investments, exceeding the initial budget of the 2021 Public Notice of BRL 300 million.

Around 46% of the amount (BRL 180 million) will be allocated to 145 municipalities with an HDI lower than the state average, which will have an additional benefit of 1p.p. in the interest rate when compared to other customers. Additionally, the new contracts will also expand the regional coverage of the public sector portfolio, as 106 municipalities did not have active operations with BDMG prior to the 2021 Public Notice.

In addition to the credit provided via Public Notice, four other lines of continuous access were also made available: the Sustainability line, for investments related to the SDGs; the Prevention line, for investments that prevent damage caused by heavy rains or droughts; the Solidário line, for emergency investments due to calamities affecting the cities; and the Vicinal Roads line, for paving and other investments in municipally managed roads.

- Performance

- |

- Sustainability Report 2021

PROJECT

PLATFORM

Structuring of concession projects: advisory to the State Government

Within the scope of the cooperation agreement signed in April 2020 with the Inter-American Development Bank (IDB) and the service provision contract with the Infrastructure and Mobility Office (SEINFRA) – in order to make investments viable, guarantee the maintenance of the stretches and strengthen the State’s logistics infrastructure – throughout 2021, the structuring of the Ouro Preto road concession was carried out, through a public consultation in July and August and adaptation of the studies after receiving suggestions based on that stage.

In August 2021, the concession contract was signed for three conservation units on the Peter Lund Caves Route, which is part of the State Parks Concession Program (Parc) of the State Forestry Institute (IEF). The model was prepared by BDMG, consolidating the Bank's operations in the project structuring segment also for the state government.

- Performance

- |

- Sustainability Report 2021

Structuring of concession projects: partnerships for the infrastructure sector

Within the scope of the Technical Cooperation Agreement signed with the State Office for the Environment and Sustainable Development (SEMAD), in order to promote public policies for environmental management and basic sanitation, BDMG has technically assisted SEMAD in the search for an economically viable solution for the creation of regional basic sanitation units, in compliance with the new legal framework for basic sanitation, via Federal Law No. 14,026 of July 15, 2020.

As part of the cooperation agreement signed with the British government, through the Brazil Green Finance Programme — UK Pact – UK Pact signed in June 2021,

consultancy services were made available to foster a partnership in waste management and disposal as a sustainable infrastructure project, on the environmental and climate agenda of the State of Minas Gerais.

In this context, BDMG has carried out studies and projections for the agreement in organizing municipalities in the State of Minas Gerais with a view to the regionalized provision of sanitation and solid waste services. The objective is to promote gains of scale and to guarantee the universal access of the Minas Gerais population to public basic sanitation services, through the submittal of Bill No. 2884/2021 by the State Government.